Taxable And Non-Taxable Transfers

C Corporation-Axle Corp Reorganization

ARE YOU LOOKING FOR RELIABLE TAXABLE AND NON-TAXABLE TRANSFERS ASSIGNMENT HELP SERVICES? EXPERTSMINDS.COM IS RIGHT CHOICE AS YOUR STUDY PARTNER!

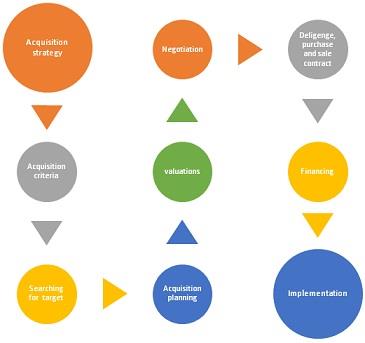

Question 1: Develop and diagram an approach for Axle and Cooke to consider, in executing Cooke's acquisition.

Answer:

Introduction: In the contents of the report, the details of the merger and acquisition process of the selected companies Axle and Cooke will be discussed. In the following components of these standard requirements, planning of the recognition process, the purpose of the merger, and different modes of shareholders interest, as well as Continuity of business Enterprise (COBE), will be analysed. In addition to that above the impact of the above-stated objects and there impact on the shareholder will be triggered in short with keeping in mind to lower the tax obligations.

Question 2: Provide a summary of the high level tax considerations that will result from a carrying-out of your plans (a type A, B or C reorganization). Include citations to controlling tax law.

Answer: Selected Companies Profile:

Alex: Alex Corporation lay its footsteps in 1995 as a wholesale distributor of the paints and lacquer in the Lowa and the US Midwest region. Later on, the company has started to manufacturing business of the same commodities and currently selling their products over the global market through big-box chains by retail distribution process (Alex-x.com, 2019).

The reason for this merger is made on the willingness of the shareholders of the Cooke Group to merge with Alex to conquer more significant market share.

GET GUARANTEED SATISFACTION OR MONEY BACK UNDER TAXABLE AND NON-TAXABLE TRANSFERS ASSIGNMENT HELP SERVICES OF EXPERTSMINDS.COM – ORDER TODAY NEW COPY OF THIS ASSIGNMENT!

Your comments should focus on the following:

A. Common Requirements

1. Plan of Reorganization

Answer: In the given case, the acquisition procedure will be made as per Section 368 (1) (c) of Internal Revenue Code 1986. In this process of acquisition, all the assets and obligations will be combined with the parentcompany (Corporatefinanceinstitute.com, 2019). Further, the voting stock where the shareholders of the parent and the acquiring company will give the same value.

In the given case as per Section 368 (1) (c) of Internal Revenue Code 1986 instead of acquisition process of one company by the parent company to its subsidiary, two independent companies have formed up to share equal equity value and to merger with each other and will carry on its business (Wills, 2019). As in, the given case, the nature of both the merging companies belongs to the same set of business; therefore, it will be easier to operate and perform the merger process.

Alternatively, as both, the companies are merging consist of different values, and moreover, the valuation of the share (book value) is different. In that case, to make them accountable in the same platform and to make equally equitable the share of both the stocks to be made on equal values, and the difference if arise will be paid either by the company or by the shareholders.

2. Business Purpose

Answer: As noted in the merging companies profile discussed above, it seems to be that both the companies have engaged themselves in manufacturing and retail distributing in the paints and Lacquer industry. Instead of cutting each other's customers and lowering the profit margins, the shareholders of both the companies have decided to merge with each other and make a more extensive control over the global market. This approach will hold good as per which the existing customer base of both the companies will come together in one shelter and both the newly formed company will enjoy more benefits such as market control, profitability and others. Further, as per this merging approach, they could take a step to compete with global leaders.

3. Continuity of Shareholder Interest (COSI)

Answer: As in the given case both the shareholders of the company has made there share values and there voting power equal than in that case the interest of both the company's existing shareholders will be kept to utmost. In addition to that, the shareholder who is not willing to continue with the proposed plan as per act they will be paid off in cash on the current value of the share held by them.

NEVER BE CAUGHT IN PLAGIARISM, AVAIL TAXABLE AND NON-TAXABLE TRANSFERS ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM AND SAVE HIGHER MARKS!

4. Continuity of Business Enterprise (COBE)

Answer: In the given case as both, the companies belong to the same source of business; therefore, in the initial period, they are likely to operate in their existing business.

B. Effect on the Corporation

Answer: As in the given case both the companies have come up together to operate in the same business and both the companies have real existence then as per the act both the company's books of accounts will come togetherand will be adjusted as per the needs of the company (Aristos et al., 2018). In addition, distort will be written off from the effecting company's profile.

C. Effect on the Shareholder

Answer: In the given case, both the companies are merging as the share are to be valued equally. In any case, if the share of one is valuing more than other than in the case, more share will be issue to high share value's owners. In the same way, in any case, the share value of any stock tends to be lower than in that case lower number of share are to be transferred as per pro-rata basis (Rani, Yadav & Jain, 2015).

D. Carryover of Tax Attributes

Answer: As per the federal tax structure, the taxation rules applied for merging if in any case any of the companies to the merger is valuing any profit or loss. In the given case as both the companies is that the Alex and Cooke have merged with equal share value is that they have forgone there existing share in the existing company and getting the same value's share of different price in the newly forming companies there is no place to score any profit or loss. If there is any valuation, increase or decrees in the market value of existing, assets, then that will be disposed of by the company. In addition, for the share those are disposed of in cash, are that the holders of the share are not willing to merger and opt to receive cash instead of share. If gained a higher price than in that case, individual taxes will apply.

Summary of high-level tax consideration and focusing on type of organisation (A, B or C): The report shall deal with the merger and acquisition process of Axle and Cooke. Alex Corporation which has started its operation in the year 1995 as a wholesale distributor of paints and lacquer in the US Midwest region. The other company which the Alex Corporation has decided to acquire is the Cooke which is a C-Corporation. The common requirements for the merger and acquisition is planning of recognition that is under Section 368 (1) (c) of Internal Revenue Code, 1986 the acquisition of the company shall be made and in the process the assets of the company shall be combined into the parent company. The merger has been held as both the companies deal in similar business. The report has also dealt how the shareholder's interest shall be protected. The report has also discussed the effect of the merger on the corporation that is the books of both the companies shall be adjusted as per the needs of the company's. The report has also discussed the effect of merger on the shareholders. The report has also discussed regarding the taxation attributes that shall be applied during the merger and acquisition procedure of both the companies.

24/7 AVAILABILITY OF TRUSTED TAXABLE AND NON-TAXABLE TRANSFERS ASSIGNMENT WRITERS! ORDER ASSIGNMENTS FOR BETTER RESULTS!