DO YOU WANT TO EXCEL IN RESEARCH METHODS ASSIGNMENT? HIRE TRUSTED TUTORS FROM EXPERTSMINDS AND ACHIEVE SUCCESS!

Research Methods Assignment - Write a Dissertation on given topic.

Topic - The relationship between Stock Market Performance and Hong Kong Property Market.

Solution -

Introduction

Financial tsunami, which is a result of the Great depression of 2008, has rendered ill effects on the economy of various sectors. There were several significant slashes in economic turnovers. The research particularly aims at the comparative study between the two identified operating sectors of the economy, namely the stock market and the real estate market.

Problem Statement

Global economic slowdown reached the worst part in Hong Kong because of the Economic Tsunami 2008. Here the significant moderation in the growth statistic was noticed to slash down to 2.44% in 2008. The last financial year recorded it to be 6.4% (asianews.it, 2019). The slowdown in the economy has resulted in the provision of a barrier of all other economic aspects within the nation. The nation has experienced a fall in the employment rate, which has mostly affected the youth of the country (asianews.it, 2019). In Spite of the issue heading back to 2008, the current economic scenario of Hong Kong is facing a setback in foreign trade, open market operations, and resolving the economic issues in the current year (chinadaily.com, 2019). The study sheds light on the effects of the financial tsunami on the performance of the stockholders and the Hong Kong property market.

Research aim

The research aims at identification of the interrelationship, which exists between stock market performance and the prices of real estate's property in Hong Kong.

Research Objectives

To understand the impact of the real estate market and the stock market performances

To analyze the impact of stock market performance on the property prices with the addition of the real interest rates and transaction volume as a variable in Hong Kong 2002-2016

Assessment of the impact of the stock market on the prices of commercial property of Hong-Kong in the period of 2002-2016

To assess the impact of the stock market on the prices of commercial property with the addition of the real interest rates and transaction volume as a variable of Hong-Kong in the period of 2002-2016

To opt for ways to deal with the economic scenario developed as a result of the great economic depression of 2008

EXPERTSMINDS.COM ACCEPTS INSTANT AND SHORT DEADLINES ORDER FOR RESEARCH METHODS ASSIGNMENT - ORDER TODAY FOR EXCELLENCE!

Research questions

1. To what extent does stock market (HSI) performance impact on residential property prices in country of Hong Kong between 2002-2016?

2. To what extent does stock market (HSI) performance impact on property of residents' prices in Hong Kong in the period of 2002-2016 by adding Real Interest Rate and Transaction volume as variables?

3. To what extent does stock market (HSI) performance impact on commercial property (office) price in Hong Kongin the period of 2002-2016?

4. To what extent does stock market (HSI) performance impact on commercial property (office) price in Hong Kong in the period of 2002-2016 by adding Real Interest Rate and Transaction volume as variables?

Literature Review

Real estate market of Hong Kong

The real estate market of Hong Kong was quite huge in the past years which needed proper management. The real estate market has numerous related products which included the housing markets, mortgage services and the obligations of debt. Chen (2001) has mentioned the involvement of all the factors in the crisis faced by the economy faced in the year 2008. The attribution of the recession in the economy is evaluated through the study of the eminent writers who focused on the factors which contributed to the significant shrink. Cheng and Zheng (2015) have assessed that the switching on of the accommodation option of the economically well off people. These people generally tend to move to private housing markets to gain their houses. Moreover, Hui et al. (2011) have coined that with the liberalization of the people to buy their own property initiating the privatization of the housings. This has resulted in the recession of the market due to the immense contraction of aggregate demand and aggregate supply in the real estate market. Inflation rate in the national economy as per the data of the last decade has faced a remarkable loss (Kakes et al. 2004). The data statistics were excluded from the prices of the property market, which have been seen to increase in the last few years where the stock market faced huge losses Liow, (2006). The huge investment needed in the real estate market can easily get bubbled up as a result of the stock market downfall which can attain much worse results in the course of time.

Stock market of Hong Kong

Sims, (2006) has stated the downfall in the stock market along with the slash of the real estate prices can result in the devaluation of the economy with a slow rate of growth. This can keep the prices of the asset far behind the expected rate in the operating market as well as stockholders (Sim and Chang, 2006). Researchers have worked on the tightening up of the foreign market flows as per the situations faced in the stock markets and real estate market operations.

NEVER LOSE YOUR CHANCE TO EXCEL IN RESEARCH METHODS ASSIGNMENT - HIRE BEST QUALITY TUTOR FOR ASSIGNMENT HELP!

Models of evaluating the effects

To identify the existing relationship between the stock markets and the real estate market there can be various models to be used, which include the concepts of Vector autoregressions and cointegration techniques of evaluation. Studies were conducted in various markets including Taiwan market, which experienced a slash in the outflow of goods, as well as the decline in the reserve storages, were explained. Application of the VAR modeling in the market operation of Turkey with the foreign operations with the stock market of Hong Kong to study the effects of the slash in the stock price and the real estate markets as well.

Impact of the stock market and the real estate market with Real Interest Rate and Transaction volume as variables

The stock markets of a nation necessarily affect real estate operations, especially while conducting foreign trade operations. The macroeconomic variables influence the market operations, which include the interest rates and volumes of transactions in the market. The liquidity of the operating market hugely affects the strategies of operations. These variables hugely affect market operations. With the regulating interest rates the market operations change in the domestic as well as foreign market (Yuksel, 2016). The Hong Kong market was also significantly affected by the model of Data mining, though the VAR model can be a steady substitute.

Research Procedures

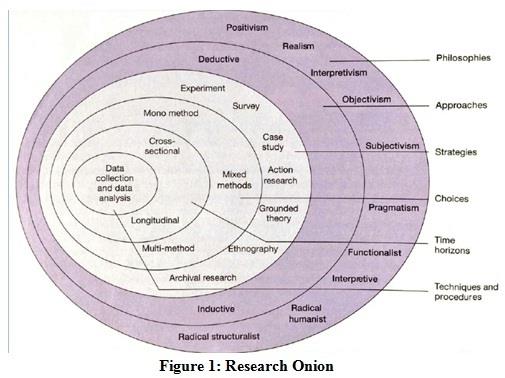

Research onion:

The research will be conducted with the philosophy of positivism, which can earn assistance inaccurate evaluation of the issues related to the stock markets and real estate projects. The featuring of the research will be conducted in the co relational design to identify the link between the stock markets and the real estate markets.

Data Collection

The research can be effectively conducted with the help of application of the Vector Autocorrelation Model to evaluate the link between the stock markets and the real estate markets within the period of 2002-2016. The result can be evaluated due to the economic depression of 2008, which was an era prior to the involvement of the Government in the market of real estate. With the VAR model, the data can be stochastically processed and the linear interdependencies of the different time-series data can be analyzed. The model can be successfully used to calculate univariate as well as multivariate data collected from the authentic sources.

Further proceedings with the project will involve the Hang Seng Index numbers (HSI) along with the data from the Private domestic - Price Indices data. These are usually available with the Rating and Valuation Department of the Hong Kong government. The taken variables respectively represent the Stock market data as well as the Real Estate Market data respectively.

ORDER NEW RESEARCH METHODS ASSIGNMENT & GET 100% ORIGINAL SOLUTION AND QUALITY WRITTEN CONTENTS IN WELL FORMATS AND PROPER REFERENCING.

The previous step will be followed by the inclusion of variables as if the real interest rates are available from The World Bank. The data collected needs to be provided by an authentic source because it will act as the primary controlling variable for the VAR model. The future conduction with VAR model will require another variable where we can use the Transaction value in the domestic sales. The department of domestic sales can always provide us with accurate data that can function as the secondary controlling variable.

To conclude the entire process of evaluating the entire process will have to be repeated with the replacement of the Private Domestic Price Indices with the data related to the Private office's Price Indices. Similarly, we can replace the Domestic Sales with Office Sales.

Sampling

The statistical analysis will be conducted with the gathering of data from the per projects, websites of stock exchange companies as well as studying the annual market report of the renowned real estate companies. The companies can be comparatively assessed as per the performance record of the years before 2008 and similarly with years after 2008.

Reflection

To proceed with the research study I have to emphasize the effects of the Financial Tsunami of 2008. The scenarios have significantly affected the market of real estate, which in turn affected the amount of Home loan that can be acquired from the banks. However, I have to work with the data available from 2002 because access is limited to that point in time only. With the better availability of the data from 1996-2000, there can be an efficient compared with the financial crisis with that of 2008.

Data of the controlling variables can only be available from the World Bank where the access is limited up to the year of 2016 for the financial reports of Hong Kong. However, with the updated data of 2017 and 2018, I can include them to the reports and evaluate in a more effective manner. The domestic incidents of Hong Kong happening between 2002-2016 except for the year of 2008, when the nation experienced huge economic slashes. The incidents include SARS, a capital inflow of mainland China and efficient intervention from the government. Such situations can render effective barriers in the path of conducting the research efficiently. The financial crisis itself has contributed to the barriers of the progress of the project. The coverage of the Government of Hong Kong was initially with the official market but in the year of 2010, the intervention in the real estate market began. The home market intervention was also conducted by the government.

I have to study the macroeconomic variables, which are operative in the Hong Kong market. The real interest rates, the value of the transaction amount as well as domestic and office sales are to be considered by me to reach out to the success of the project.

I have to conduct proper data analysis from the collected data from the authentic sources which are to be collected from the sources. Collection of data from the World Bank as well as government sources of Hong Kong will be utilized by me efficiently.

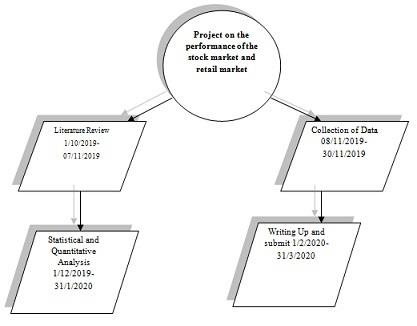

Timetable

GET GUARANTEED SATISFACTION OR MONEY BACK UNDER RESEARCH METHODS ASSIGNMENT HELP SERVICES OF EXPERTSMINDS.COM - ORDER TODAY NEW COPY OF THIS ASSIGNMENT!