Principles of Accounting Assignment Help

Q1. Discuss in your words the purpose of a bank reconciliation.

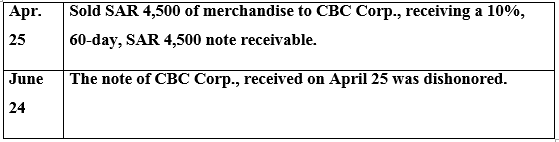

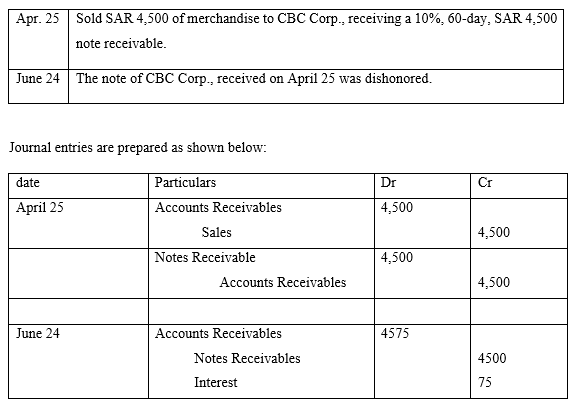

Q2. Prepare general journal entries for the following transactions of this company for the current year:

Q3. A company purchased mining property containing 7,350,000 tons of ore for SAR 1,837,500. In 2009 it mined and sold 857,000 tons of ore and in 2010 it mined and sold 943,000 tons of ore.

a. Calculate the depletion expense for 2009 and 2010.

b. What was the book value of the property at the end of 2010?

Q4. Define liabilities and explain in your words the differences between current and long-term liabilities.

Expertsminds.com accepts instant and short deadlines order for Principles of Accounting Assignment Help service – order today for excellence!

Q1. Discuss in your words the purpose of a bank reconciliation

Bank reconciliation is undertaken with an eye on reconciling the cash balances in the books which is maintained by the client company and the balance maintained by the bank in the pass book. As there are many items which are undertaken during a year which sometimes makes it sure that cash is either deferred till paid and sometimes the same is received but not entered in the books, the bank reconciliation becomes a necessity to know the exact and correct bank balance at the end of the year.

Q2. Prepare general journal entries for the following transactions of this company for the current year:

Q3. A company purchased mining property containing 7,350,000 tons of ore for SAR 1,837,500. In 2009 it mined and sold 857,000 tons

of ore and in 2010 it mined and sold 943,000 tons of ore.

a. Calculate the depletion expense for 2009 and 2010.

Depletion in 2009 = (1,837,500/7,350,000*857,000) = 214,250

Depletion in 2009 = (1,837,500/7,350,000*943,000) = 235,750

b. What was the book value of the property at the end of 2010? Book value = 1,837,500 - 214,250-237,750 = 1,385,500

Q4. Define liabilities and explain in your words the differences between current and long-term liabilities.

A liability is defined as the obligation of someone or a company to pay the debts in the future to a third party. It can be either be a loan or a debt or amounts owed to supplier. If there is a liability, then the business or the owner is obligated to pay the supplier or the lender at a future date.

Liabilities can either be current liability or long term liability.

A current liability is a liability which would be required to be paid within a period of one year. For example the accounts payable or a bank overdraft. Even salary or wage outstanding is a current liability.

On the other hand the long term liability is a liability which would be required to be paid over a period which is longer than a year. For example liabilities like bonds, notes payable ( more than 1 year), bank loans et are long term liabilities.

Never lose your chance to excel in Principles of Accounting Assignment Help service – hire best quality tutor for assignment help!