Pricing Factors

WORK TOGETHER WITH EXPERTSMIND'S TUTOR TO ACHIEVE SUCCESS IN PRICING FACTORS ASSIGNMENT!

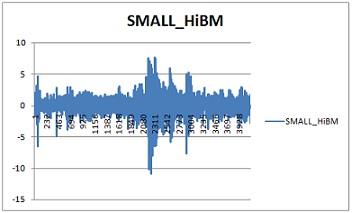

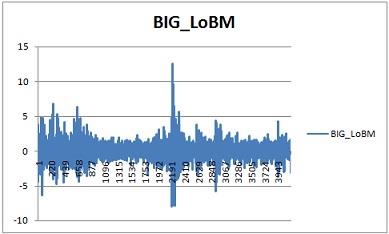

Part A: 1. How are the pricing factors computed and what do they represent? Provide graphs and descriptive statistics for the SMALL_HiBM and BIG_LoBM portfolios and comment on their main characteristics.

Answer: Fama French Three-Factor Model

The CAPM (Capital Assets Pricing Model) can be expressed as follows:

Ri=Rf + βi RMRF

Here Ri denotes expected return of security/asset

Rf is risk free rate of return

βi is a systematic risk measure

RMRF is the market risk premium = Rm-Rf

Rm = return expected from the market.

There are many ways to estimate the value of βi.

Traditionally, the analysts used 60 month data and then carried out regression on market return. So, we get the slope as βi.

So, we see that in a manner Ri is a function of the independent variable βi.

If we plot average return versus βi we get a straight line.

But Fama French Three-Factor Model adds the size value stocks and growth factor (BTM-Book-to-market ratio) along with existing factor. So, it includes two more factors.

Fama French Model can be given by:

Ri=Rf + βi RMRF + βisize SMB + βivalue HML

CAPM proved that if value of α is greater than zero, then it means return is higher.

βisize considers the size effect and its a measure of size and βivalue considers the BTM effect.

SMB means small minus big. It measures value or gross stock.

HML means high minus low. It measures sensitivity of asset i return.

In order to form these portfolios, we first find the median of ME (Market value of equity).

All values above this are placed under the category large and all values less than this are placed under the category small. So, 2 columns are formed as follows.

The rows are divided into 3 parts by 2 lines which are 70th percentile B/M and 30th percentile B/M.

These percentiles are found by ranking all stocks according to Book-to- Market value.

The various steps involved in the analysis are:

1. Find SMB, HML, Ri-Rf, Rm-Rf

2. Run multiple regression.

Small_HiBm shows variation in both positive as well as negative direction.

Big_LoBm shows variation in both positive as well as negative direction.

SAVE YOUR HIGHER GRADE WITH ACQUIRING PRICING FACTORS ASSIGNMENT HELP AND QUALITY HOMEWORK WRITING SERVICES OF EXPERTSMINDS.COM!

Question 2: Consider the following two models:

(SMALL_HiBMt - risk_freet) = ß0 + ß1mkt_rft + ß2hmlt + ß3smbt + et

(BIG_LoBMt - risk_freet) = ß0 + ß1mkt_rft + ß2hmlt + ß3smbt + et

What signs (positive or negative) would you expect to estimate for each of the factors in equations (1) and (2)? Explain the reasoning behind your answers?

Answer: (SMALL_HiBMt - risk_freet) = ß0 + ß1mkt_rft + ß2hmlt + ß3smbt + et

High book to market equity ratio - Weak firm, ß2 is positive, it raises the firm's return variances and implies higher average returns.

(BIG_LoBMt - risk_freet) = ß0 + ß1mkt_rft + ß2hmlt + ß3smbt + et

When BME ratio is low - Strong firm, ß2 is negative, it raises the firm's return variances and implies lower average returns.

Question 3: Estimate both models given in question 2, and present the fitted equations. Interpret the fitted coefficients. Which parameters are statistically significant at the 5% level? Are the estimated parameters of the same sign as what you expected in Question 2?

Answer: (SMALL_HiBMt - risk_freet) = ß0 + ß1mkt_rft + ß2hmlt + ß3smbt + et

ß1mkt_rft , ß2hmlt and ß3smbt are significant.

The model is attached in Excel file.

|

|

Coefficients

|

|

|

Intercept

|

0.006779

|

|

|

-0.71

|

0.833503

|

b1

|

|

0.44

|

0.946702

|

b3

|

|

-0.97

|

0.680859

|

b2

|

(BIG_LoBMt - risk_freet) = ß0 + ß1mkt_rft + ß2hmlt + ß3smbt + et

|

|

Coefficients

|

|

|

Intercept

|

0.005412

|

|

|

-0.71

|

0.952247

|

b1

|

|

0.44

|

-0.17776

|

b3

|

|

-0.97

|

-0.31774

|

b2

|

Yes, the signs are same to the ones predicted in Q2.

ORDER NEW PRICING FACTORS ASSIGNMENT AND GET 100% ORIGINAL SOLUTION AND QUALITY WRITTEN CONTENTS IN WELL FORMATS AND PROPER REFERENCING!