Personal Expenses Budget Assignment Help

1. Create a personal expense analysis for a three month period and then create a chart of your expense data.1. Start Excel and begin a new blank workbook.

• Type Personal Expenses and your first and last name at the top.

• Type in the current month as your first column heading, and use the fill handle to create a series so that three consecutive months display as column headings.

• Type Total and Percent of Total to the right of the months as your last two column headings.

2. Enter Income as your first row heading.

• Below Income, enter at least six row headings for your monthly expenses. Some of the items you might list include, but are not limited to: Rent, Utilities, Daycare, etc.

• After you have entered all of the categories, type Balance and Expense Total as the last two row headings.

3. Enter the amounts that you anticipate spending in each category for the next three months.

4. Create formulas to show totals.

• In the Total column, enter formulas to calculate category totals.

• In Percent of Total column, enter a formula to calculate the percentage of the overall total that goes towards each expense (category).Hint: If you use an absolute cell reference for the first formula, you can use the fill handle to copy it to the other cells.

• In the Balance row, enter a formula that calculates income minus total expenses for each month.

• In the Expense Total row, enter a formula that calculates total expenses for all three months.

5. Format the worksheet by adjusting column width and wrapping text, applying appropriate financial number formatting, adding borders and fill colors, and adjusting the fonts and font sizes of the title and column headings.

6. Create a 2-D Pie chart that shows the percentage breakdown of your expenses by category.

• Make sure your pie chart includes data labels.

• Size and move the chart so that it displays centered below the worksheet data.

• Choose an appropriate layout and design.

Hire professional writer from Expertsminds.com and get best quality Personal Expenses Budget Assignment Help and homework writing services!

Personal Expenses Budget

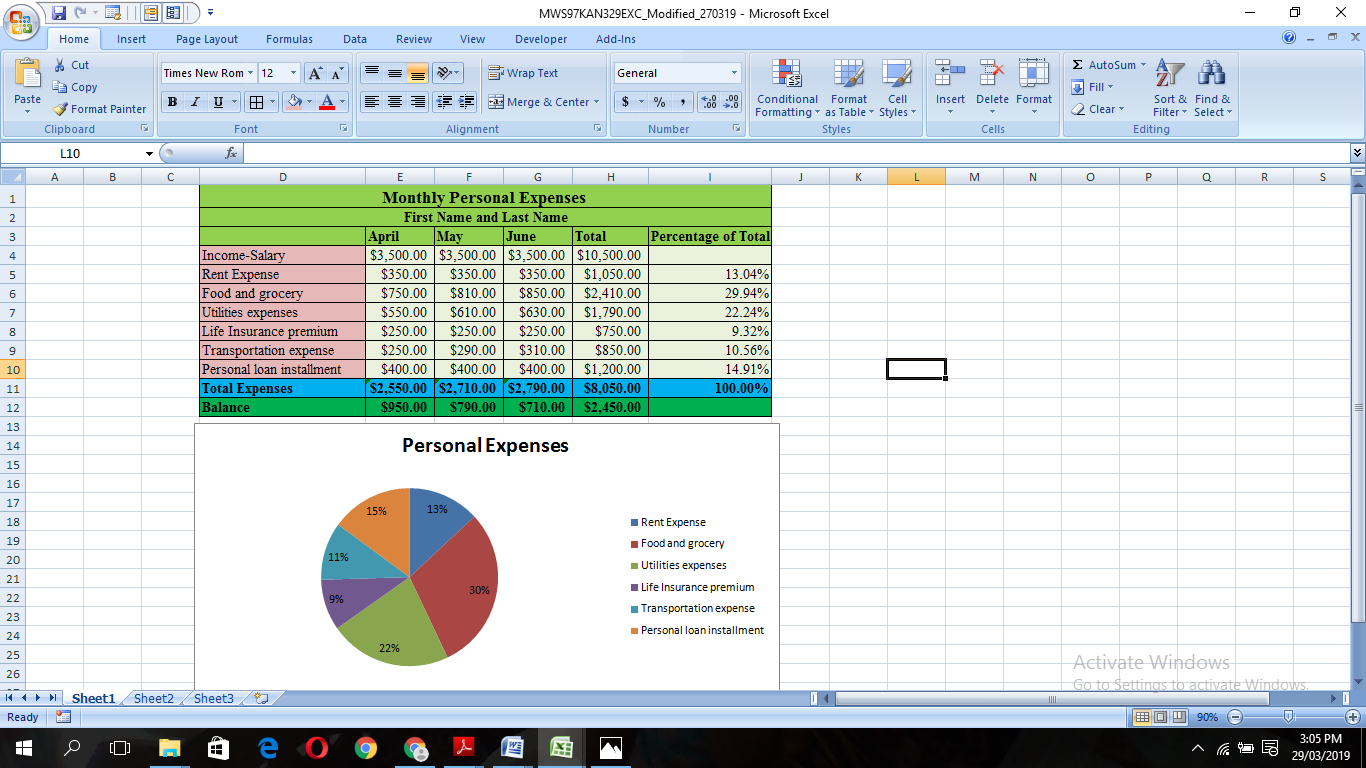

Personal Expenses Table and Pie Chart of Personal Expenses

Analysis of Expenses

Personal expenses are difficult to manage to some extent due to not fixed and rigid manner outflow of earnings. There are several issues that can cause changes in personal expenses like eating habit as there are not in a rigid manner because of vary one time to another time. These expenses can be controlled to some extent. The personal expenses analysis in a 1st month indicates total expenditures of $2,550 whereas the total earnings of $3,500 which means the savings in the hands would be around $950 which can be used in the second month for the expenditure. The personal expenses in a 2nd month are $2,710 whereas the total earnings are $3,500 so the total saving in this month is $790 which can be used in the next month. The total expenses in a 3rd month are $2,790 whereas the earnings are $3,500 which provides total savings of $710.

Significant Expenses

The quarterly analysis reflects the highest portion of food and grocery expenses to the total expenses because it is around 29.94%. The second highest expense is of utilities expenses which around 22.24% of total expenses. 3rd high portion expense to the total expenses is Personal loan installment which forms around 14.91% portion of the total expenses. Another expense which is Rent expense is also critical for personal expense because it forms around 13.04% of the total expenses so it is estimated that there are four most important expenses which should be focused for controlling total expenses within the budgeting. Transportation and insurance expenses are forming least part of the portion for the purpose of placing control over these expenses for improving the saving. The portion of individual expense to the total expenses reflects on a quarterly basis also reflects the monthly individual expense to the monthly total expenses more or less. Therefore, there is a need to find controllable and non-controllable expenses for managing proper budgeting of the personal expenses to improve the overall savings (Taggart, 2000).

Expenses Management

Further the fixed expenses include rent expense, life insurance premium, and personal loan installment which are not controllable as these are to be paid periodically for the purpose of meeting personal needs. Income in the form of salary is also not controllable in the hands of the individual because of fixed to some extent over the period of at least around twelve months. Food and grocery expenses and utilities are not in fixed nature so these expenses can be controlled to a great extent for increasing savings for better management of the funding in the hands. However, transportation expenses are not much controllable as these are incurred for workings for earnings and other purposes; it has the little scope of control to improve the savings (Friedberg, 2015).

Save distinction marks in each Personal Expenses Budget Assignment Help solution which is written by our professional writer!