Operational Risks Assignment Help

Using the traditional, six-step Risk Management Process described in the textbook on p. 5.19 entitled “The Risk Management Process,” take three hazard risks through the six-step process.

DO WANT TO HIRE TUTOR FOR ORIGINAL OPERATIONAL RISKS ASSIGNMENT SOLUTION? AVAIL QUALITY ASSIGNMENT WRITING SERVICE AT BEST RATES!

Introduction

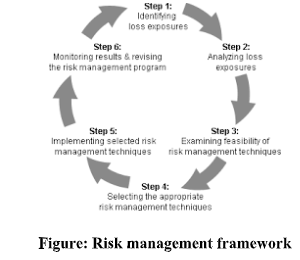

Risk management is the most effective way to mitigate all the traditional risks associated with the organization. The risk management of the organization must comply with the local rules and regulations. It helps to address all the uncertainties associated with the organization which can adversely affect the organizational culture and employee rights. Apart from, that, risk management is the most effective way to address the potential hazards associated with the organizations and initiates to investigate the possible interventions of the identified risks. The risk management framework is the most impactful way to mitigate the potential hazards. The six basic components of risk management framework are the identification of the risk exposures, analyzing the loss exposures, examining the feasibility of risk management, selection of risk management techniques, implementation of the risk management techniques and monitoring and revising the risk management program. This study will analyze the risk management process of three traditional risks for business organizations. The traditional risks of business originations include market risk, accidental risk, and strategic risk. The proper utilization of each component of the risk management framework is capable to mitigate all the traditional hazards and risks. The analysis of the risk management framework based on all three traditional risks will be conceptualized in the study. The concluding part of the study will summarize all the key points of the analysis part. Thus, the analysis of the risk management framework is impactful in reducing the traditional risks of the organization.

Analysis

Identification of risk exposures

This part helps to identify the potential risks associated with the organization. The first way to identify the risk is to have a proper understanding of the type of risks which may harm the organizational culture and affect the ethical rights of the employees. The potential hazard may include the lack of workplace security for the employees, the risk associated with resources and risks associated with the financial issues (Bromiley et al., 2015)

Market risk: The market risks can be identified by identifying the stock price and availability of the interest rates. Moreover, the market risks can be identified by analyzing the threats from the competitors, threats from the new entrants, product diversity, and trend to expand the customer base. The identification of market risks is essential to evaluate the effectiveness of the risk and help to find out the process for risk mitigation (Bromiley et al., 2015).

Accidental risk: The accidental risks in the workplaces include professional hazards, being struck by the moving pieces of machinery, vehicle accidents, workplace fire accidents, and workplace stress injuries. The accidental risks can be identified by analyzing existing risk assessment management of the respective organization (Bromiley et al., 2015). For example- the availability of fire extinguisher, the maintenance of workplace security equipment and the maintenance of work-life balance.

Strategic risk: The strategic risks include marketing strategy risks, human resource strategic risks, and operational strategic risks. Marketing strategic risk can be identified by analyzing the capability of market research and understanding the customers' preferences. The human resource strategic risks can be identified by analysis of the recruitment process, selection process, training process, performance developmental process and employee management process (Bromiley et al., 2015). The operational risk can be identified by analyzing the number of financial frauds, insecure investments, incapability of applying the management decision and the number of financial and marketing issues the organizations have witnessed.

Analyzing the loss exposures

The loss exposures analyze the amount of loss the organization has witnessed. The loss exposures can be measured into four parts loss frequency, loss severity, a total amount of loss and the timing.

Market risks: The loss frequency defines the total number of loss within a particular span of time. The analysis of the market risks includes the failure of marketing decisions and inappropriate market selection and failure in understanding the consumer's claims and bad debts. In the case of market risk, the loss frequency can be measured by analyzing the number of debts in the market. The maximum debts and inappropriateness in understanding the market requirements signify severe marketing disaster of the organization (Bromiley et al., 2015) Apart from that, the loss frequency in the marketing segments can also be identified by executing the inappropriateness of implementing the marketing decisions. This may results in a disastrous financial outcome and witnessing severe marketing drawback. The loss frequency of the operational risks can be analyzed by evaluating the performance of the marketing control department of the business organization.

Accidental risks: The loss exposure in accidental risks may result in the failure of organizational culture and underperforming the ethical considerations of workplace security regulations. Moreover, the loss of exposure to accidental risks can also be determined by analyzing the occurrence of workplace accidents. The failure in maintaining the proper workplace security and workers healthcare are the reasons for the loss exposures accidental risks (Bromiley et al., 2015). The severity of accidental risk can be analyzed by identifying the amount of the total amount of debts in the market (Sarabdeen, 2014)

Strategic risks: The loss exposures of the strategic risks can be fatal from the future decision-making of the organization. The loss in marketing strategy may be adversely impactful in the increasein the customer base and brand value. The loss operational strategy human resource strategy may violate the organizational culture and results in unethical staffing process which can reduce the employee efficiency and organizational growth. The operational failure and inappropriate implementation of the decision-making are the outcomes if the loss exposure of the operational strategy (Sarabdeen, 2014).

Feasibility of risk management

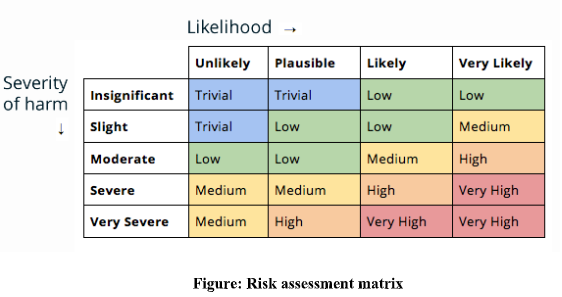

The feasibility of the risk management technique is adapted to control and assess the traditional risks which include marketing risks, strategic risks, and accidental risks. The risk assessment is one of the most necessary steps to evaluate the financial injury which the organization has witnessed. The traditional risks can be assessed by evaluating the impact and outcome of the identified risks and potential hazards. It includes catastrophic risk, major risk, moderate risks, minor risks and insignificant risks (Wu et al., 2014).

Marketing risk management

The assessment of market risk can be analyzed by evaluating the existence of market debts, the number of total market shares, the availability of marketing potentials, the availability and the availability of the investors in the market. The assessment of marketing risk management helps to manage the availability and ghastliness of the existing risks (Wu et al.,2014). Apart from that, the marketing risk also indicates the significance of the risks and its impact on the current market by assessing the capabilities of the marketing competitors.

Accidental risks

The assessment of the accidental risk is helpful to understand in hand and the total amount of financial exchange via tax cash dealings (Wu et al., 2014). The assessment of accidental risks is helpful to evaluate the severity of the accidents and the measures taken to reduce the number of workplace accidents.

Strategic risks

The risk feasibility of the strategic risks assesses the number of strategies which have failed to accomplish the organizational goal and has created potential hazards to the organizational growth. The assessment of the feasibility of marketing strategy signifies the total number of underperformed marketing strategy (Sarabdeen, 2014). The feasibility of human resource strategic risks indicates the number of employees who are unethically selected without having the proper qualification or disqualified during the selection process. The risk feasibility of operational strategies indicates the number of failed attempts to mitigate operational risks.

Selection of risk management techniques

The evaluation of the traditional considerations is impactful on selecting risk management techniques. The three most effective ways to analyze the financial risk managementtechniques are as a forecast of the loss expectation, a forecast of the combination of all traditional risks and a forecast of the all traditional hazards after the involvement of tax costs (Grigolon et al., 2014). The most appropriate technique to evaluate the market risks, strategic risks andaccidental risks are to adopt the technique of forecasting each feasibility of the combination of all the traditional risks.

Implementation of risk management technique

It is important to implement the selected technique to mitigate all the traditional risk after the selection of the risk management technique. A forecast of all the feasible combination of all traditional is the selected risk management technique. The adaptation of the risk management technique can be helpful for organizations to mitigate all the potential hazards of traditional risks (Huston et al., 2015).

Monitoring and reviewing

The monitoring and reviewing the outcome of the implementation of the forecast of all feasible combinations can be helpful to address the ongoing financial activities of the financial organizations with constant attention (Sarabdeen,2014)The outcome monitoring ismost appropriate way to address the loss exposures after the technique implementation, development of the previous loss exposures and identifying the new risk management techniques for the development of the existing traditional risks (Huston et al.,2015).

Conclusion

The study has unfolded the effectiveness of risk management techniques to mitigate traditional risks. The traditional risks include market risk, accidental risks, and strategic risk. The six basic components of risk management techniques are the identification of the risk exposures, analyzing the loss exposures, examining the feasibility of risk management, selection of risk management techniques, implementation of the risk management techniques and monitoring and revising the risk management program. The effective implementation of risk management aspects is capable to mitigate all the traditional risks.

NO PLAGIARISM POLICY – ORDER NEW OPERATIONAL RISKS ASSIGNMENT AND GET WELL WRITTEN SOLUTIONS DOCUMENTS WITH FREE TURNITIN REPORT!