MCR001 Economic Environment

ORDER NEW MCR001 ECONOMIC ENVIRONMENT ASSIGNMENT & GET 100% ORIGINAL SOLUTION AND QUALITY WRITTEN CONTENTS IN WELL FORMATS AND PROPER REFERENCING.

Title: Impact of trade restrictions between USA and China on the Australian economy

Topic : China’s response to trade war

Question 1 General Introduction. Trump started the Trade War. Were his ‘reasons’ economically sound?

I. Introduction:

The trade relation between China and US, two economic powerhouses has changed dramatically during Trump administration. The implications of such trade war are far reaching as it significantly affects the global trading system. US has imposed several rounds of tariffs on Chinese products like steel, aluminium, solar panel and many others in order to protect American industry and jobs. In retaliation, China also takes suitable measures to safeguard the legitimate rights and interest of their economy. This tit for tat move has escalated the tension of trade war between the two. (Tan, 2018)

ORDER NEW COPY OF MCR001 ECONOMIC ENVIRONMENT ASSIGNMENT AND SECURE HIGHER MARKS!

US has imposed a wave of tariffs on various Chinese goods and China immediately responded to such unreasonable US measures. In retaliation to new round of tariffs imposed by Trump, China has introduced counter measure with the urge to defend the dignity of the country. It has been observed that whenever US imposed new rounds of tariffs, China retaliates with countermeasures with same scale and strength. (Jane Pong, 2018)

Question 2 How did China Respond? (Domestically and Internationally) – What economic principles did they base their response on?

II. China’s response at the domestic front:

Domestically China is responding in a very precise way. In order to protect the workers affected by U.S trade measures, China government has increased the government expenditure. With the help of strategic measures, China ensures that domestic companies should not be impacted by this crossfire. (BBC, 2018)

After the announcement of latest round of tariff by Trump administration, China is looking forward for other clients abroad. At the current scenario, China has kept hold their expansion plan in US market. Moreover, US has several big business operations in China which will be hardly hit if China takes aggressive counter move measures. China has the confidence to keep the things under control and strongly belief that US- China trade war will do more harm to US economy than Chinese economy. (Vaswani, 2018)

GETTING STUCK WITH SIMILAR MCR001 ECONOMIC ENVIRONMENT ASSIGNMENT? ENROL WITH EXPERTSMINDS’S MCR001 ECONOMIC ENVIRONMENT ASSIGNMENT HELP SERVICES AND GET DISTRESSED WITH YOUR ASSIGNMENT WORRIES!

Overall the immediate impact of Trade war on China is not significant. The impact is estimated as less than 0.5% of China’s GDP that can be within control. China is unlikely to devalue its currency Yun against dollar because of its own interest. Chain is still enjoying positive trade balance over goods and services and thus interested to maintain a stability over its exchange rate.Moreover, China has started to provide strong focus to curb its credit growth. (Lau, 2018)

Question 3 How is the Trade War impacting the Australian economy? (Use economic concepts)

III. China’s response at the international level:

The trade war between US and China has gained a momentum as US has imposed a new round of tariffs on Chinese goods that includes food products, construction materials and auto parts. Trump has announced this new round of tariff on July 10, 2018. The newly imposed tariff is $200bn on Chinese goods considered as the largest round so far. According to this new round of tariff, almost 50% of the Chinese goods in US are subject to duties. (BBC, China accuses US of trade bullying as new tariffs imposed, 2018).

In a quick response, China also has retaliated with a tariff of $60bn on US goods. More than 90 percent of the products on which China has imposed duties are found to be the intermediate goods that are imported by US firms to assemble for their end products. Thus, China’s such retaliation move will significantly affect US business and raise the price of US products. AS a result, US consumers will worse off. (BBC, China accuses US of trade bullying as new tariffs imposed, 2018)

China has shown exponential economic growth for last few decades. Despite current economic slowdown, China has experienced impressive growth rate rather positive growth rate for a longer period of time. China’s economy is vast and very much immune to external turbulence. China is planning to replace US as their major export market and the process has been accelerated after the new rounds of tariff. (Lau, 2018)

Internationally China is now more open to the foreign companies. China’s market is vast with immense opportunities. It is a lucrative market for the foreign firms- a growing number of firms are either interested on technology transfer or simply start business operations here. China has reduced some restrictions and even removes the restriction for the foreign ownership banks operating in their country. China has made complaint against U.S at WTO before and planning to file another fresh complaint soon. China accuses US on the charge of the trade bullying that hurts global economy. At the bottom line, China is now well prepared with domestic as well as international strategy to hit back in response to Trump’s protectionist measures. (Bulloch, 2018)

DO WANT TO HIRE TUTOR FOR ORIGINAL MCR001 ECONOMIC ENVIRONMENT ASSIGNMENT SOLUTION? AVAIL QUALITY MCR001 ECONOMIC ENVIRONMENT ASSIGNMENT WRITING SERVICE AT BEST RATES!

AS US- China trade war escalates, Australia’s economic growth is exposed to potential risk. The prospect of Australia’s growth momentum will slow down because Australian exporter’s risk are caught up in the escalating trade war between the two economic powerhouses. China is the biggest export market for Australia, thus any economic set back to China will have substantial impact to Australia. An economic slowdown in China will reduce the demand for Australian goods like iron ore, coal other commodities huring Australian exports. UBS economists have predicted that approximately 1.2 million workers who work in export related industries could be impacted.(Farrer, 2018)

Question 4 What is the current state of the Trade War? (Use economic concepts)

IV. Welfare effects of tariff on China: economic principles

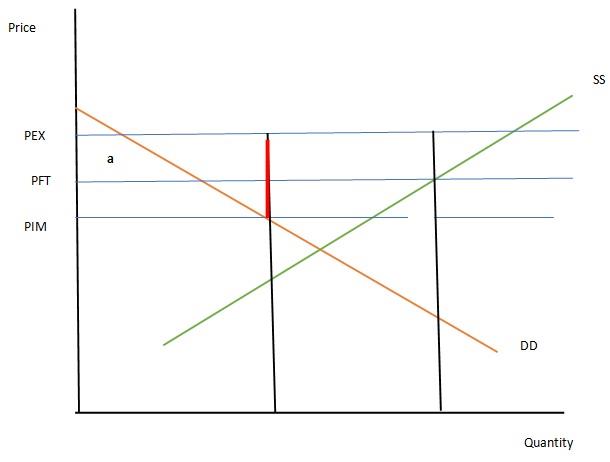

The welfare impact of import tariff on Chinese economy can be shown with the help of fundamental demand supply graph:

Welfare effects of tariff on exporting country China

With the above illustrated demand -supply diagram, we can explain the direction and magnitude of welfare effects of tariffs on China, the exporting country here.

Due to import tariff, there will be an increase in domestic supply and decrease in the domestic price. Due to fall in domestic price the consumers of China will experience an increase in the consumer surplus as represented by the +a in the above figure, Producers will experience a huge loss as the imports are now restricted and the price has also come down domestically. The loss of Chinese producers can be represented by the area -( e+f+g+h) in the above figure. Needless to mention that the revenue for Chinese government is zero. Since the loss of Chinese producers are more than the gain realised by Chinese consumers, there will be an overall fall in China's national welfare, known as deadweight loss. This can be represented as the area -( f+g+h) .(Suranovic, 2004)

Question 5 What advise would you give to both countries? (Use economic concepts)

V. Conclusion:

With a new round of tariffs, U.S and China have embarked into a full scale of trade war. According to China's finance minister Liu Kun, if US continues to impose more and more tariffs then China will also hit back. He further argued that there is no intention of China to engage in trade war with US but if US initiates and continues to impose trade protection measures then China has to protect their interest and take corresponding action. (BBC, US-China trade war: China to respond 'resolutely', 2018)

There is no doubt that continuous trade protection measured by Trump administration on Chinese goods has put China in a difficult position. According to JP Morgan analyst China should eased out is monetary policy and enact appropriate fiscal measures to combat such challenge. (Tan W. , 2018)

Despite the fact that the immediate impact of US tariff is negligible for China's economy, the long-term effect is significant. It will adversely affect the long-term economic tie between the two countries. The escalation of trade war between two economic powerhouses in likely to continue in the foreseeable future. (Lau, 2018).

GET GUARANTEED SATISFACTION OR MONEY BACK UNDER MCR001 ECONOMIC ENVIRONMENT ASSIGNMENT HELP SERVICES OF EXPERTSMINDS.COM – ORDER TODAY NEW COPY OF THIS ASSIGNMENT!