SAVE TOP GRADE USING MACRO ECONOMICS - FIRMS AND MARKETS ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM

Macro Economics - Firms And Markets Assignment

Question: Find GNP/GDP data for the last 5 years. Plot the growth rate. Compute total factor productivity (TFP) and plot the results for that period. Show how the TFP numbers are calculated according to the formula derived in class.

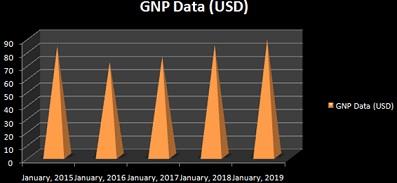

Answer: Expansion of any company unit to foreign lands needs the thorough analysis of the GDP, GNP rates. The GNP of Malaysia was recorded to be nearly 87USD bn in the financial report of 2019. However, (Rahman et al.2017) has recorded the data to be less from that of the data of December, 2018. The record of data for the past five years in the GNP report can be cited as:

|

Years

|

GNP Data (USD)

|

|

January, 2015

|

83k

|

|

January, 2016

|

71k

|

|

January, 2017

|

75k

|

|

January, 2018

|

84k

|

|

January, 2019

|

88k

|

Table 1: Gross National Product of Malaysia, 2015-2019

(Source: tradingeconomics,2019)

Figure 1: Gross National Product of Malaysia, 2015-2019

(Source: tradingeconomics,2019)

Analysis

The report bears the evidence which shows that from January 2015 to January 2019 the GNP report is quite diverse. Initially it increases but in 2016 the GNP rate reduced to below 80k, which gradually increases up to above 85k in the year 2019. GNP rate has proved to be quite steady in the Malaysian market which can easily attract the investors. This in turn helps the country to exceed further in the approach.

GETTING STUCK WITH SIMILAR MACRO ECONOMICS - FIRMS AND MARKETS ASSIGNMENT? ENROLL WITH EXPERTSMINDS'S MACRO ECONOMICS - FIRMS AND MARKETS ASSIGNMENT HELP SERVICES AND GET DISTRESSED WITH YOUR ASSIGNMENT WORRIES!

Total factor productivity

The total factor productivity of a nation defines the rate of output derived from the total labor incorporated in the processes of production. The importance of TFP lies in measuring the fluctuations of growth, development quotients which contribute to the future decision making process of the nation (Hajian et al. 2017). The calculation of TFP in any nation is done with the help of the following equation:

TFP= Total product/ Weighted average of inputs

The Total Product is measured with summation of the Marginal Product of the nation. Mathematically:

Total Product= ΣMarginal Product of the GDP/GNP analysis report

Weighted Average of inputs= Average of labor inputs+ Average of capital inputs

The formula is derived from the Cobb-Douglas production function which states the change in the quantity of growth earned with respect to the rate of involvement of the labor and capital.

Y=A*K^α*L^β

Where Y is the output and K and L is the unit involved as capital unit or labor unit.

The total product of a nation is counted by the evaluation of the agricultural product, manufacturing products, as well as the service products produced. The entire product calculated is measured with respect to the variables unit of labor, capital and additional variables used as input.

However, the change in the TFP of a country is derived as per the changes in the Total factor productivity changes (TFPCH). This is measured as a product of the Technical Efficiency Changes (EFFCH) and the Technological Change (TECHCH).

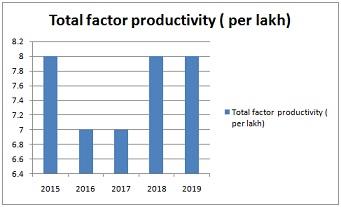

In Malaysia the Total Factor Productivity report from 2015-2019 can be cited as per the following report:

|

Years

|

Total factor productivity ( per lakh)

|

|

2015

|

8

|

|

2016

|

7

|

|

2017

|

7.5

|

|

2018

|

8.4

|

|

2019

|

8.8

|

Table 2: Total factor productivity of Malaysia

(Source: worldbank.org, 2019)

Figure 2: Total factor productivity of Malaysia

(Source: worldbank.org, 2019)

Analysis:

The TFP reports show that Malaysia has a quite stable TFP rate in the last few years with no huge slash or hike. Such an economic approach can always be utilized to gain a proper market in Malaysia.

SAVE YOUR HIGHER GRADE WITH ACQUIRING MACRO ECONOMICS - FIRMS AND MARKETS ASSIGNMENT HELP & QUALITY HOMEWORK WRITING SERVICES OF EXPERTSMINDS.COM

Question: What is the earnings yield (inverse of the price-to-earnings ratio) in the domestic stock market? Is this number compatible with the performance of the economy as analyzed in the previous question?

Answer: Earning Yield

The economic ratio representing the linkage between the earnings of a company or an individual with the stock price of the share market is defined as the Earning Yield (Wu and Heberling, 2016). Mathematical formula which is used to derive the earnings yield of a company for a fixed time is:

Earning yield= Earning per share in the previous year/ Stock price

The earning yield is used to depict the possible returns from the market as well as helps in evaluating in the liability of the financers (Woo, 2016).

For Malaysia, the earnings yield of the domestic stock market calculates the amount of dollars which was involved in the stock market within the previous year.

The total factor productivity of the country measures the economic conditions existing in the company as a total. The areas of strength within an economy lie in the stock market absorption by different companies. With hike and fall in the stalk market issues there can be essentially an adverse or positive effect on the earning yields, which contribute to the Gross National Product of the nation (Hassan et al. 2015). Stock market inclusions bear the evidences for the global operations of a particular nation. This has the capacity to deal with the different values of the market operations as well.

As per Sow (2019), earning yield can be grouped as good yield or bad yield, which can be opted as a result of the performance of the company. The contribution of the company in the global market lies in earning a better score of Gross National Product. The product analysis can be marked for the effectiveness of the earning yield. The stock market operations are to be evaluated as per the earning yield with measuring the Total Factor Productivity. The earning yield represents the share of the individuals as per the current market scenario. The stocks are to be analyzed to yield out the Total factor productivity.

As per the thoughts of (Rath et al. 2019), negativity in earning yield actually provides a negative ratio where the stock price gets lowered. The Earnings per share gets reduced as per the market scenario especially the current regulating price contributing to the GNP.

NO PLAGIARISM POLICY - ORDER NEW MACRO ECONOMICS - FIRMS AND MARKETS ASSIGNMENT & GET WELL WRITTEN SOLUTIONS DOCUMENTS WITH FREE TURNTIN REPORT!