HA2042 Accounting Information Systems, Holmes Institute, Australia

Case Study - Adam & Co

GETTING STUCK WITH UNIVERSITY ASSIGNMENT? ENROL WITH EXPERTSMINDS'S HA2042 ACCOUNTING INFORMATION SYSTEMS ASSIGNMENT HELP SERVICES AND GET DISTRESSED WITH YOUR ASSIGNMENT WORRIES!

Executive summary: Adam & Co. follows a lengthy process of purchasing their materials, paying their employees and managing the disbursement system. They have four departments for each process which adds up to their cost of running the company. An overview of how the departments work, the risks and the challenges associated with it has been provided. This report reflects on a definite orientation of assessing the right purpose of flowchart that allows creating an accurate understanding of the different auditing systems followed by Adams & Co. The recommendation made enhances on reflecting the positive aspect on creating these flowcharts.

Introduction: Companies require keeping a track of their quantity of products, disbursement proceduresand the due paymentsto their purchases and employees. Arrival of each item goes through various departments that check the items individually. Each department especially the accounts department and the treasurer need to be kept updated. Without a well defined flow of information among the different departments, the system will break down due to confusion and chaos. The following study focuses on the expenditure cycle of a Perth based company Adam & Co. The company is a wholesaler of industrial supplies. This study sheds light on the weakness of internal control system and the risk associated with the weakness in reference to Adam & Co Further the charts declared identifies the analytics of the different auditing system,. The flowcharts deliver the right analysis to which the processes are discussed and further they are responsive to set the different observation on auditing analysis of Adams & CO.

Question: Prepare a report to the Managing Director to evaluate the processes, risks and internal controls for its expenditure cycle. In your report, you need to include the following items:

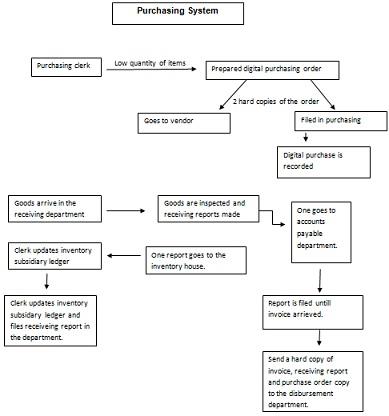

a. System flowchart of purchases system

Answer:

Analysis of Purchasing System: A company needs to buy either raw materials or finished products to carry out its services. In accordance to Ghobadian et al.(2016), such systems are required to keep track of the cash flow. All the documents need to be filed properly by each department as the payment is ultimately made on the basis of these documents. The purchasing clerk checks the number of items on the inventory subsidiary ledger. If the items show low quantity, he/she prepares a digital purchase order which is sent to a particular vendor. Copies of the order are sent to the vendor and the purchasing department where the order is recorded.

During product arrival, receiving department of Adam & Co inspects the products, and matches them against the digital purchase and the packing slip or the bill. The receiving department of Adam & Co. also prepares two receiving reports. One goes to the inventory warehouse with the goods and the second goes to the accounts department. At the inventory warehouse the goods are shelved Clerk updates inventory subsidiary ledger and files receiving report in the department. At the accounts payable department of Adam & Co, the report is filed until the invoice from the supplier arrives. As soon as the file arrives, all the accounts related to payment are updated. A copy of invoice, receiving report and purchase order copy are delivered to the disbursement department which looks after the payment for the supplies.

ORDER NEW HA2042 ACCOUNTING INFORMATION SYSTEMS ASSIGNMENT AND GET 100% ORIGINAL SOLUTION AND QUALITY WRITTEN CONTENTS IN WELL FORMATS AND PROPER REFERENCING!

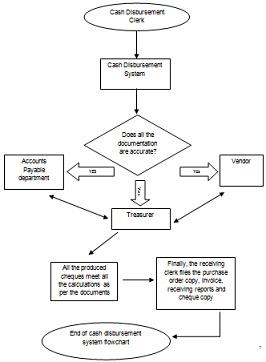

b. System flowchart of cash disbursements system

Answer:

Figure 2: Flowchart of Cash Disbursement System

Analysis: Cash disbursement system is needed by every business in order to securely handle the cash payments of the company. Most of the transactions are closely tied to cash disbursements. As per Turner et al. (2016), cash disbursement requires specific documentation handling the financial records of a company. Similarly, Adam & Co also focus on proper documentation processes in order to keep financial records of its payments so that there is no lag in the payment process.

Accounts payable department plays an important role in approving the credit transactions and payments on company's vendor. Thus, the accounts payable department of Adam & Co upon receiving invoices from the purchasing department and makes necessary paperwork for the final approval of the transaction. The paperwork is then transferred to the cash disbursement clerk. The clerk further verifies the accuracy of the applications made and files the documents till the payment due date. On the due date of payment, the cash disbursement clerk produces a cheque for the invoiced account. The cheque is then sent to the treasurer who verifies the produced cheque with the documents. As stated byLee et al. (2019), the main purpose of a treasurer is to manage the cash inflows and outflows of a business. Thus, the treasurer is required to monitor all the cash inflow and outflow activities in order to ensure the presence of sufficient cash so as to fund the business operations. Therefore, the treasurer of Adam & Co ensures that the produced cheque meets all the calculations as per the documents before approving the cheque. After the approval of the cheque from the treasurer, it is mailed to the Vendor. In addition to this, the cash disbursement clerk updates the cheque register, accounts payable control account and the accounts payable subsidiary ledger from their computer terminal. In the final step, the receiving clerk files the purchasing order, receiving report, invoice and cheque copy within the department.

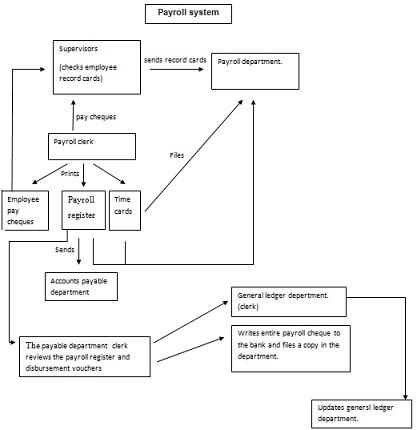

c. System flowchart of payroll system

Answer:

Analysis payroll system: Adam & Co. follows a lengthy payroll system. It is done so to keep in check the honest commitment of its employees, to be sure to pay everyone and keep each department updated. There are about four departments for this purpose and each is connected to each other through a general terminal. All the departments have to individually check the documents provided by the employees and the other departments.

Employees at Adam & Co. maintain time cards which are reviewed each week by the supervisors. The supervisors check the card and forward it to the payroll department. The payroll clerk then updates the information in the central system and makes copies of employee pay cheques, payroll register and time cards. Employee pay cheques are received by the supervisors, time cards by the payroll department and payroll register by the Accounts Payable department. Lastly the payable department clerk and writes an entire payroll cheque to the bank, payroll register and disbursement vouchers are forwarded to the general ledger clerk who in turn updates the general ledger department. This payroll system also helps in defining the right track of individual employees. In fact, this prolonged analysis helps in understanding and tracking the right employee time card order. The supervisors also get a chance to rectify, if there are any mistakes within the payroll structure. Productively, the act of such defined services, where the payroll clerk is almost responsible for all action helping to create the analytical response of guiding an advanced set of function within the companies.

NEVER BE CAUGHT IN PLAGIARISM, AVAIL HA2042 ACCOUNTING INFORMATION SYSTEMS ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM AND SAVE HIGHER MARKS!

d. Description of internal control weakness in each system and risks associated with the identified weakness

Answer: Description of internal control weaknesses in each system and the risks associated with the identified weakness.

Internal control weaknesses

• Separation of duties: Adam & Co. lengthy task makes sure of no errors, yet such lengthy separation of duties delay the job of purchasing and paying process. In view of Sun (2016), a lot of human resources and company's finances go into maintaining the departments. Many divisions also increases the risk of fraud and corruption within the departments.

• Computer failure: Most of the Adam & Co. departments are connected via a general node. The dysfunctioning of this node can create communication problems for the company. Again, as commented by Darroughet al. (2018), a lot of finances go into maintaining such a large number of computers and the data in them.

• Mistake in audit: The company's interconnected finance system can face a lot of problems due to a mistake in one of the systems. As suggested byLee et al.(2019 )Mistake of input of data in one system can mislead the entire process of purchasing or paying the employees. Adam & Co helps in solving these mistakes through the defined acquisition of flowchart.

• Lengthy process: The overall process of Adam & Co maintainance system is long and time consuming. Goods are delivered from one department to the other can delay further procedures. Though the processes are lengthy, there are processed analysis that helps in creating an identifiable record helping to recover from any manhandled issue or any issue of auditing. This also rectifies issues of supervisors in the process of accumulating accurate report.

Associated risks: The lengthy process of buying products can delay they arrival this. This can cause the company heavy financial loss if they do not manage to reach the order targets on time. This inturn will cause the company its brand image. Loss of connection from the general node can cause the company delays and thus affecting the work of all the departments. As mentioned above, the goods are sent from one department to another and not stored directly by Adam & Co. This can damage the fragile products and bring loss to the company.The associated risk also includes a parameter of risk in accounting. In reflection to the definite assistance of delivering the right records to specific departments, there are reflective ways that such associated accounting risks can be handled. In fact, the concerned parameter is guided by the productive ways taken to analyse the associated risks. In response to the flowcharts drawn, there has been reflected identification how these flowcharts work to be an assisting ways to reduce risks. On a prolonged identification, there are concerned parameters of enhanced analytical prospectus that caters to trigger a positive analytics. In fact, the flowchart helps in identifying the process of the system that allows to enhance the strategy of working. Precisely, the observation made are cared and response to set the appropriate brand image.

Conclusion: The company keeps a record of their quality and quantity of products, employees and their payments. In order to do this, there are certain procedures that the company possesses certain procedures in purchasing system, cash disbursement system and payroll systems. The company is also required to be ensured about the internal control weaknesses and the probable risks due to the identified weaknesses. Thus, the study has discussed about the purchasing system, cash disbursement system and payroll system. This has further covered the flowchart of the three types of systems. Additionally, the study has also discussed about the internal control weaknesses in each of the systems. It has also shed light on the associated risks that might occur due to the identified weaknesses.

Recommendations: Adam & Co. can reduce the number of departments that run the organization. This will not only reduce the running cost for the company but also increase trust among the departments. It will also lead to a fast processing of purchasing and paying customers. They can also conduct regular meetings to check the performance and working hours of each employee and then following the lengthy process. Strict internal laws are necessary for reducing the risks of cases of fraud and corruption. Each employee should sign papers related to the lawsuits of the company in case they are found to be involved in any activity that the company deems to be unlawful. Even after constant checks there can be issues related to frauds and errors. Mitigation of such issues requires proper management of contracts laid down by the company, summarizing there legal procedures in case of frauds. Such companies should always have more than one supply chains that will help them in times of emergency. Lastly strong and targeted marketing is of outmost importance to maintain as well as regain the company's lost image.

Acquire brilliant Holmes Institute, Australia assignment help services for its related courses and units such as:

- HA1011 - Applied Quantitative Methods Assignment Help

- HA1022 - Principles of Financial Management Assignment Help

- HA2011 - Management Accounting Assignment Help

- HA2032 - Corporate & Financial Accounting Assignment Help

- HA2022 - Business Law Assignment Help

- HA3011 - Advanced Financial Accounting Assignment Help

- HA3021 - Corporations Law Assignment Help

- HA3032 - Auditing Assignment Help

- HA3042 - Taxation Law Assignment Help

- HA1020 - Accounting Principles & Practices Assignment Help