Final Financial Ratio Analysis Assignment Help

Assume that you are a health care consultant hired by the Dependable DME Company. DME is Durable Medical Equipment and includes all equipment that benefits patients who have certain medical conditions. The owner of the company, David Smith, is interested in applying for a loan to expand his business; he desires to open a second location in another city. He is preparing to apply to a local bank for a loan.

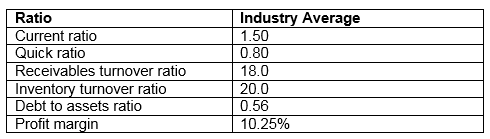

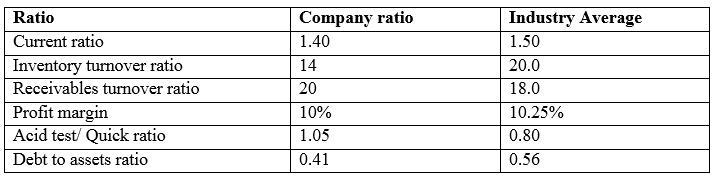

The bank will base its decision on the following averages for the DME industry:

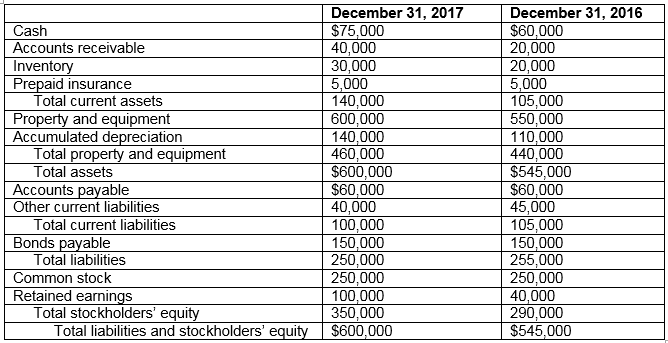

The balance sheet data for Dependable DME Company follows:

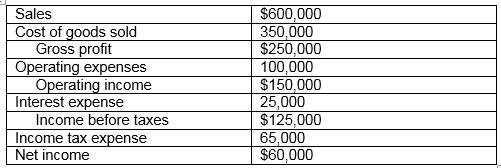

The income statement data for Dependable DME Company follows:

Required:

1. Calculate the following six (6) ratios: Current Ratio, Quick Ratio, Receivables Turnover Ratio, Inventory Turnover Ratio, Profit Margin Ratio and Debt to Assets Ratio. Be sure to show the actual calculation as well as your final answer.

You are only required to calculate the ratios for 2017; however, for two of the ratios (Receivables Turnover Ratio and Inventory Turnover Ratio), you will need data from 2016 for the formula. When calculating the Quick Ratio, please note that Short-Term Investments are $0 in this scenario.

2. Below each ratio, comment on the interpretation of the ratio. In other words, what does the result tell you, specifically?

3. Based upon the industry averages upon which the bank relies, should they approve the loan to Mr. Smith? Why or why not?

4. In one-half page, comment on what financial aspect of Dependable DME Company looks good and where can Mr. Smith make some improvements. Specifically identify at least two recommendations to Mr. Smith that can be made to improve the financial position of his business.

Get assured A++ grade in each Final Financial Ratio Analysis Assignment Help service order – Order for originally written solutions!

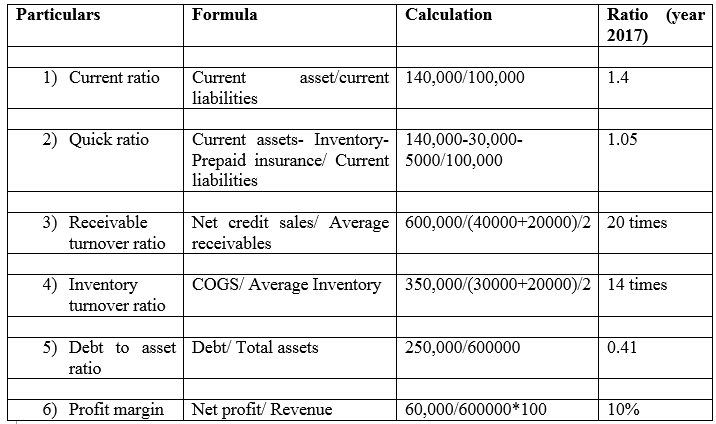

1) Ratio Analysis:

2) Interpretation of the Ratio:

i. Current ratio interprets the liquidity condition of the entity which describes the capacity of the company to pay off its short term obligations through its current assets. The ideal current ratio should be more than one and in this case it is 1.4 which states that the company is having sufficient current assets to pay off its short term obligations.

ii. Quick ratio: It determines the capacity of the entity to settle its short term obligations from its quick assets. The ratio above one is favorable for the company as it interprets that the company is having readily available cash to settle its short term liabilities.

iii. Receivable turnover ratio: It is a type of efficiency ratio. It elaborates the no. of times a company can turn its trade receivable into cash. It measures the capacity of the entity to collect its receivable. Thus higher ratio is better for company as it describes that the company is quickly converting its receivables into cash.

iv. Inventory turnover ratio: This ratio is used to determine the efficiency of an entity to control its stock/ inventory and it explain that the company can sell its inventory efficiently which its buys. In other words it measures the number of times inventory is sold during a period. Thus the higher ratio is beneficial for the company as it indicates that the company is efficiently selling its inventory.

v. Debt to asset ratio: This ratio determines the total amount of debt in proportion to the assets. Alternatively it is a measure of the assets of an entity which are financed by the debt and in this case debt to asset ratio is 0.41 which states that the 41% of the assets are backed with the debt and rest is backed by the equity.

vi. Profit margin ratio: This ratio measures the profitability of the company and it shows the amount of net income earned from the sales of the company. In other words we can say that it shows the percentage of sales remained after paying off all the expenses of the company and thus the higher the percentage of the profit, higher is the benefits to the company.

3) Analysis of whether loan has to be given to the company:

The performance of the given company is quiet good in comparison to industry average. From the above table we can see that the current ratio of the entity is little bit lower than the industry average but still it is quiet good and the company is having enough current assets to settle its current obligations. Moreover the quick asset ratio of the entity is good in comparison to industry average which means that company is having enough liquid cash to meet its obligation. Similarly the company is having better receivable turnover ratio in comparison to industry average which states that the entity is easily converting its receivables into cash. Further the debt to asset ratio is also good in the entity as compared to industry average which means that the entity's asset is only financed by the 41% of debt whereas in industry average it is 56%. Moreover the net profit margin of the entity is equivalent to that of the industry. Thus it is evident that the entity is having strong position and company is liquid and has enough cash availability. Therefore bank should provide loan to the entity as company is showing good financial performance and having good financial position in comparison to the industry and company is having good liquidity and debt to asset ratio which will provide reliability to the bank that loan can be easily paid off.

4) Recommendation to improve ratios:

Most of the ratios of the company are equivalent to average of industry's ratios which explain that the entity is performing equivalent to other entities performing in same industry. The Quick ratio of the entity is above industry average which demonstrates that the entity is having more liquid assets and is more efficient to pay off its short-term liabilities from its liquid assets. It shows that the liquidity position of the company in terms of liquid assets is better than industry average. The debt to asset ratio of the entity is also better than average ratios of the industry which is also a strong side for the company. The company should strengthen its profit margin ratio and current ratio because these ratios are below average of industry's ratios. The current ratio of the entity is 1.40 whereas industry average is 1.50. The company should create more current assets or should discharge its current liabilities to improve the ratio because higher the current ratio strong will be the liquidity position and stakeholders will be more interested in that company which is having strong liquidity position. The company should also improve profitability margin because higher the margin better will be market capitalization of the company.

No Plagiarism Policy – Order New Final Financial Ratio Analysis Assignment Help solution & Get Well Written Solutions Documents with Free Turnitin Report!