EFIC 698 International Finance, Investment and Capital Flow Assignment Help

1. Suppose that Bell Aliant (a Canadian firm) expects to receive 1 million euros in one year. The existing spot rate of the euro is CAD 1.50. The one-year forward rate of the euro is CAD1.52. Bell Aliant expects the spot rate of the euro to be CAD 1.51 in one year.

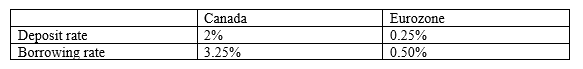

Assume that one-year put options on euros are available, with a strike price of CAD1.53 and a premium of CAD 0.06 per unit. Assume the following money market rates:

a. Determine the dollar cash flows to be received if Bell Aliant uses a money market hedge (i.e. foreign exchange swap). (Assume the firm does not have any cash on hand.)

b. Determine the dollar cash flows to be received if Bell Aliant uses a put option hedge. What conclusion would you draw between the money market hedge and the put option hedge in the case of Bell Aliant?

2. Suppose that the USD – CAD spot exchange rate is USD = CAD 1.34 and the 180-day forward rate is USD = CAD 1.30. Suppose the 180-day U.S. interest rate is 2.15% and Canada’s 180-day interest rate is 2.75%. Based on this information:

a. Is covered interest parity arbitrage by Canadian investors feasible (assuming that the investment is CAD 1 million and that Canadian investors use their own funds? Explain.

b. Does interest parity exist? Explain.

c. Explain in general terms how various forms of arbitrage can remove any discrepancies in the pricing of currencies.

3. Use the purchasing power parity (PPP) theory to answer the following.

a. A Canadian importer of American car parts pays for the components in USD. The importer is not concerned about a possible increase in U.S. prices (charged in USD) because of the likely offsetting effect caused by PPP. Explain what this means.

b. In (a), from what you have learned about the tests of PPP, explain why the Canadian importer of American car components should be concerned about its future payments.

c. (i) Explain how the USD to CAD exchange rate might change if Canada experiences high inflation, while the U.S. experiences low inflation.

(ii). Assume that the spot rate is CAD = USD 0.75 and Canadian and U.S. inflation rates are similar. Suppose that Canada experiences 3% inflation, while the U.S. experiences 2% inflation. What will be the new value of the CAD after it adjusts to the inflationary changes? (You may use the approximate formula to answer this question.)

4. One Canadian executive commented that the United Sates was not considered as a location for foreign direct investment (FDI) because the US dollar value was too strong. Interpret this statement.

Explain any two reasons why Canadian firms might prefer to engage in FDI in Mexico rather than in the U.S.

5. Explain how the declining international reserves could be a prelude to a financial crisis.

How did high levels of leverage in financial institutions contribute to the Great Recession of 2007-2009? What other factor or factors could have also contributed to the Great Recession and how?

Save your higher grade with acquiring EFIC 698 International Finance, Investment and Capital Flow Assignment Help service & quality homework writing services of Expertsminds.com

Solution 1:

Given is the following information:

Existing spot rate is Euro = CAD 1.50

One year forward rate Euro = CAD 1.52

After one year

Spot rate Euro = CAD 1.51

a) Since receivables are to be hedged, therefore the Canadian firm will take loan of the present value of the Euro receivables i.e. 1 million Euro discounted at the Euro borrowing rate @0.50% which is equal to 10,00,000/1.005 = Euro 995,024

Thus after one year the loan amount including the interest at 0.50% would be exactly Euro 1 million.

The amount of Euro 995,024 is converted into Canadian dollar at the spot rate Euro= CAD 1.50 to get Canadian dollar 1,492,536.

The Canadian dollar amount is placed on deposit at the rate of 2% so that the maturity amount after one year will be:

1,492,536* 1.02 = C$ 1,522,386

Now when the payment will be received the Canadian firm uses this money to repay the Euro loan of 1 million. Since it received C$1,522,386 for this dollar amount, it effectively locked in one year forward rate i.e. C$1,522,386/Euro 1 Million = 1.52.

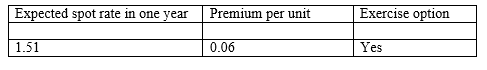

b) Expected spot rate of the Euro = CAD 1.51

Premium Euro = CAD 0.06 per unit

Total price Euro = CAD 1.57

Strike price Euro = CAD 1.53

Premium paid= CAD 0.06

After the expiry of the one year the spot rate is 1.51 which is less than the strike price of the option i.e. CAD 1.53

Thus the put option will be exercised and the net flow of the cash will be:

Premium paid = 0.06

Total cash inflow = 1,470,000

From the above two hedge it is concluded that the money market hedge should be exercised by the Canadian firm in order to increase its cash flow. The money market hedge will give the better result to the firm as compared to the put option hedge.

Solution 2:

Spot Exchange rate USD=CAD 1.34

180 day forward rate USD=CAD 1.30

180 day interest rate in US= 2.15% and in Canada it is 2.75%

a) Interest rate parity can be understood as a theory in which the lot of the forward premium or discount should be equal to the interest rate differential between the two countries. Thus when the interest rate parity exists, covered interest arbitrage is not feasible and the reason behind this is that interest rate advantage in the foreign country will be offset by the discount on the forward rate.

The covered interest rate parity equation is as discussed below-

1+Rd/ 1+Rf = F/S

The interest rate differential is (2.75%- 2.15%) =0.6%

Forward discount = 1.30-1.34/1.34*360/180*100

= 6%

Since the interest rate differential is not equal to the forward premium or discount.

In the given case investment is CAD 1 million and we will convert it into Euro at spot rate @ 1.34 which will be equal to the 746,268. Now will sell it forward 762,314 including interest. In 180 days when the deposit matures the forward contracts obligations can be fulfilled by converting 762,314 using forward rate i.e. CAD 991,008.

Now return from covered interest arbitrage is less than the return if you had invested in the domestic country.

Therefore the covered interest arbitrage is not feasible.

b) The covered interest rate parity equation is as discussed below-

1+Rd/ 1+Rf = F/S

According to this

The forward rate will be:

1.0275/1.0215 = F/1.34

F= 1.34

Thus the interest rate parity is not true in this case because according to interest rate parity Forward rate should be 1.34 and also the differential interest rate of the two countries is not equal to the forward premium or discount. In other words the interest rate parity does not true in this case because the differential in the interest rate of the two countries is not equal to the difference between the forward rate and the spot rate.

c) The arbitrage helps to remove the discrepancies in currency prices, and it realigns the prices. There are three forms of arbitrage i.e. triangular arbitrage, location arbitrage and covered interest arbitrage. Location arbitrage realigns the prices to adjust the prices in different locations such as under this arbitrage the user buys the currency where the prices are cheaper and sell the currency where the prices are higher. In case of triangular arbitrage, the realignment is done based on capitalization on discrepancies in cross exchange rates between two different currencies. Under Covered interest arbitrage, interest rate differential between two currencies are capitalized and realignment is done.

Solution 3:

a) Purchasing power parity deals with the inflation exchange rate relationship. In the given case, the Canadian importer is not concerned about the increase in the price in the U.S. because the inflation is offset by the purchasing power parity. In other words purchasing power parity is the exchange rate which allows buying the same amount of goods and services in every country. It gives the law of one price discusses that the price of the same products of two different countries should be equal when it is measured in the common currency. Thus when the rate of change in the prices of the products should be similar when it is measured in the common currency. The purchasing power parity can be discussed as :

1+Id/1+If = F/S

b) Since the Purchasing power parity theory determines the law of one price but there are some assumptions such as there are no transportation costs and no differential taxes are applied between the two countries and it also states that there will be no tariff on the imports or any other restrictions on the trade. But the fact is that in practical scenario there is a restriction on the trade and tariff is imposed on the import which will drive the prices for the similar goods. Moreover traders without information about the price differences will not respond to the profit opportunities and thus price will not be equal. Moreover when the price of the individual goods in the consumption bundle constantly deviates from the CPP in the two countries and when the competition is perfect. Thus in the given case the Canadian importer should be concerned about its future payments.

c) Given is the following information:

Spot rate CAD =USD 0.75

Inflation rate in Canada is 3%

Inflation rate in USA is 2%.

According to the purchasing power parity

1+Id/1+ If = S/F

1.03/1.02 = 0.75/F

F= 0.74

Thus the new forward rate will be CAD= USD 0.74

Solution 4:

Foreign investment analysis:

The statement given by Canadian executive that US is not the right place for Foreign Direct Investment because the US dollar value is too strong is partially correct. If the US dollar become stronger then Canadian FDI will be required more amount of Canadian Dollar and his investment amount will be increased tremendously. The firm doing businesses in US will be required more to obtain US dollars and investment amount will be increased due to increase in dollar rate. The outside investor will have negative impact of strong dollar for an investor at the time of investment. Further it is also not expected that dollar will rise or become stronger at the same pace because if the dollar will not become strong in future after investment thenit will also impact in negative way to the Canadian Investor. After Investment, if US dollar rises then it is better for investor because at the time of repatriation of funds, the investors will earn more domestic currency from conversion of US dollar. Thus, we can conclude that US is not right place for FDI by Canadian firm because the US dollar is very strong currently in comparison to Canadian Dollar and it is also not expected to become more stronger US dollar in future in comparison to Canadian dollar.

The Canadian firms prefer to do business in Mexico instead of US because there are several benefits to invest in Mexico which are as below:

The Mexico government has done major improvements in trade policies and has signed the agreement with Canadian government with preferential access to potential Canadian consumers and reduced tariff on various goods whereas the trade policies of US government are very stringent and there is no preferential access to potential Canadian consumers. Further the US government has also increased tariffs on various items. In Mexico the skilled workers are available at unskilled labor rate due to introduction of NAFTA agreement and further the Mexico Peso is cheaper than US dollar which is also one of the biggest advantages.

Solution 5:

International reserve and financial crisis:

International reserve is the reserve of foreign currency held by a country. The reserve can be in many forms such as foreign assets, foreign currency bonds and shares, gold and precious metals etc. Most of the countries are facing the issue of decline in international reserve which can be resulted into financial crisis. Most of the countries uses foreign currency to do international business and if the international reserve decline then the country needs to purchase more foreign currency and it has to spend more money to buy foreign currency which can be resulted into financial crunch for that company. The shortage of international reserve also impacts monetary and exchange rate policies and the government would not be able to maintain the policy in the favor of his country. The financial crunch at worldwide level would also impact the country’s economic environment.

The year 2007-2009 was very challenging for whole of the world and the world faced huge recession and financial crisis. The high levels of leverage in financial institution contributed to financial crisis during the period because the financial institutions disbursed high amount of loan to the corporation and the corporation were facing huge financial losses and the whole amount of disbursement was set off with financial losses and the world faced the recession. The financial institutions were high levered and they could not maintain their adequacy and liquidity ratio and it resulted into huge recession.

The other major factors which led to great recession were such as filing of bankruptcy by major corporations such as Lehman Brothers, Indymac bank was collapsed and other banks were under extreme pressure because big corporations were unable to pay their debt obligations. Further the federal fund rate and discount rate was also decreased to great extent which led to recession.

Expertsminds.com accepts instant and short deadlines order for EFIC 698 International Finance, Investment and Capital Flow Assignment Help service – order today for excellence!