Compensation Plan Assignment Help

Develop a progressive yet competitive compensation plan that will support recruiting and retention efforts and lower the employee turnover rate. Traditionally, Motors and Morehas provided employees minimum wage and statutory bene?ts.

A. How does Motors and More’s employee compensation compare relative to other organizations in the area? Will the organization meet, lead, or lag the local market? Explain your rationale.

B. Identify alternative pay methods and discuss the advantages and disadvantages of each.

C. What bene?ts will you offer? Include statutory bene?ts. What are the costs of those bene?ts? What is the rationale for offering those bene?ts?

D. Develop a communications plan regarding how employees will be informed about the compensation plan. Define the sequence of communications considering the who, what, and when of the message.

Do you want to excel in Compensation Plan Assignment Help solution – Order at Expertsminds now!

Answer 1:

With the lower rate of employment, there are organizations who need to decide on how one is able to meet the competition with the pay. If there is a lag behind the market, then Motors and More might not be able to hire the staff which is qualified enough. Hence, the company needs to decide about leading other organizations which follows, the different procedures. The hiring advantage is seen to be lost, when Motors and More are having an increased cost without any benefit. There are alternatives about the decisions for using the incentives and the bonuses which are for the better competency of resources (Verwaeren et al., 2017). The compensation planning is done for the overtime wages, with bonus and the recognition to handle the standard vacation policies. Here, the employee base pay does not include the compensation that might raise the wages above the base level. The salary includes the gross and the net wages which includes the other overtime wages as well. The benefits are about proceeding with the desirable output with offering a lower base pay to the employees. The benefits are desirable in different areas and industry that requires to look over the compensation regulations which is generally governed by the local, state and the federal taxation. The planning is done when the employee tends to receive the exchanges for the services which are provided to the employers. The larger costs or the expenses are for the organization with cash compensation of the wages and the salaries. They are also for the employer paid health insurance and the life insurance planning. The compensation wages are based on how the employees are paid for the hourly and the annual salary. Here, the variable rates are based on the performance of employees (Williams et al., 2019).

Answer 2:

The alternative payments are for rewarding the employees through:

a. Merit Payments: This includes the employee rewards which are over the last performance. The employees have to know about the resistance planning. Over the time, the merit has been increasing employees base pay with increasing the cost of organization. The employees might not be able to see the link in between the merit pay and its relative performance (David et al., 2016).

b. Incentives and Bonuses: They are for handling the performance without any additions made to the base sale. Hence, they link the pay with performance. The examples are about manufacturing and handling the plan which pays the employees a certain amount for the different units produced. The group incentives tend to increase productivity with problems in unhealthy competition.

c. Commissions: They are based on tasks and sales of product. The commission pay plan is on how the performance of employees with commissions are received. This includes the direct link payment to performance, with payment plans that cause the employees to behave unethically for the sale. Hence, the commission reward individual and not the performance of team.

d. On-Spot Awards: They are depending upon the behavioral planning, where the awards might include the gifts and the certificates or cash. They focus on the attention of goals and objectives (Adkins et al., 2018). The employees can look for the goals with performance and rewards. The awards can lead to resentment or unfairness if the managers use the criteria for giving the same.

e. Gainsharing and Profit Sharing: The incentives are for the employees which are awarded for the reduction in cost and for improving productivity. The savings are based on how the employees and companies are able to make use of participative management styles. They include understanding about decreased cost of labor. The planning is done to reinforce the improvement and find out the productivity baseline. The difficulty is about the organization paying the cost reductions, when the profits are seen to be declining. The employees are rewarded, where the payments do not seem fair for all employees.

Hence, the payment values are added with providing flexibility for payment distribution. It includes the individual performance and profits (Shortland, 2018).

Answer 3:

There are Motors and More which focus on handling the different forms of the statutory benefits related to employment. The planning is done for the statutory standards which includes the security at a social level, handling the compensation of workers and the other unemployment compensation. The security needs to focus on the retirement and the disability of the income which can lead to the supplementing of unemployment insurance. They are generally funded by the contributions which are done in between employer and employees. The worker compensation is then able to cover the medical costs and how employee payments are done if they are not able to work due to the illness of job, injury or any other type of disability (Coplan, 2017). This is paid for the organization with unemployment providing income to employees who tend to lose their jobs as well. The statutory benefits are based on providing a better approach with the financial assistance. The statutory forms include the benefits for the employees with coverage that is purchased through Property and Casualty Broker along with handling the Liability Policies. They are for Compensation Premiums which are based on the classification of jobs and payroll of employees (Kumar et al., 2016). The group long term disability insurance is expressed with maximum salary and then handling elimination periods for the time of 90 or 180 days. The employers pay for unemployment where the compensation is based on handling the locations or the layoffs with termination planning. Family Medical Leave Act requires the employers who are 50 or more to allow the employees to take up the 12 weeks of the unpaid leave which is set at the time of 12 months period for handling the personal and the other related issues of family health. This Act ensures about the employees whocan handle the same positioning with equal status and pay. The Act then requires the employers to maintain the health coverage of employee, if needed. The planning is done for the different benefits which can offer the medical, dental and the retirement or the tuition reimbursement with vacation time. Motors and More afford to offer the better extensive benefits where the students will need to offer the benefit packages which will include the different incentives based on the flexible plan of medical. It will include the higher deductibles which might be affordable for the organization. Motor and More which needs the leadership team to discuss on the benefit options with the employees (Campion et al., 2017). The advising is given to the students with retirement, childcare and the eldercare for the visionary benefits which is a part of the solution. They are then justified for the cost and benefit analysis. The style of the health care benefits is to provide a complete flexibility for the employees and then help in containing the costs which will help in sharing the same effectively.

Answer 4:

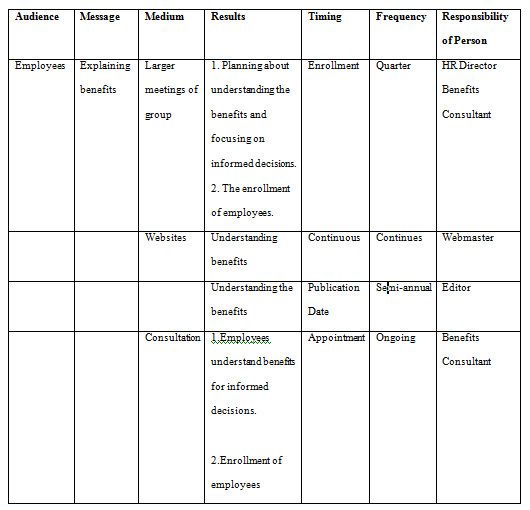

The communication plan needs to be tailored based on the different audiences and planning. Here, there is a need to check on information with the same format. The check is on the examples which tends to extend the package of benefit, managers and the supervisors, who needs to be informed about answering the questions of employees (Ivancevich et al., 2013). They need the information for helping them decide about the enrollment in the planning.

The discussion is about how the different mediums, or the methods are used for handling the procedures. They are effectively able to handle the management team which requires the group or the one-on-one meeting. The employees will require the details depending upon the documentation which includes the reading and revisit. The planning is done for the desired results where the audience specifications and the management is to understand the new benefits which are enrolled in the planning. One needs to be supportive so that the employees are able to work with enthusiasm and plan about the enrollment with the desired results.

It includes the process of communication with timing and the frequency based on how the messages or the versions could be set or presented for the audience. The benefits of the same are about highlighting the timing in a month before there is a beginning of the enrollment period. There are frequency to match which starts when the week is started and is increased to twice a week with the enrollment period that is then drawn to closure. The communication plan is to succeed where the people are assigned to the execution of the plans with holding the responsibility to complete it in a given time.

Never be caught in plagiarism, Avail HRM Compensation Plan Assignment Help service of Expertsminds.com and save higher marks!