EXPERTSMINDS.COM GIVES ACCOUNTABILITY OF YOUR TIME AND MONEY - AVAIL TOP RESULTS ORIGINATED CASE STUDY - ADAM AND CO ASSIGNMENT HELP SERVICES AT BEST RATES!

HA2042 - Accounting Information Systems - Holmes Institute

Case Study - Adam and Co

LO1: Understand and explain the place of an accounting information system in the context of the organisational structure and operating practices.

LO2: Identify, analyse and compare different types of accounting information systems.

LO3: Use different methodologies to evaluate various accounting information systems.

Prepare a report to the Managing Director to evaluate the processes, risks and internal controls for its expenditure cycle. In your report, you need to include the following items:

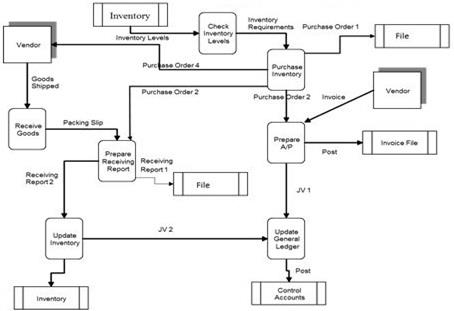

- System flowchart of purchases system

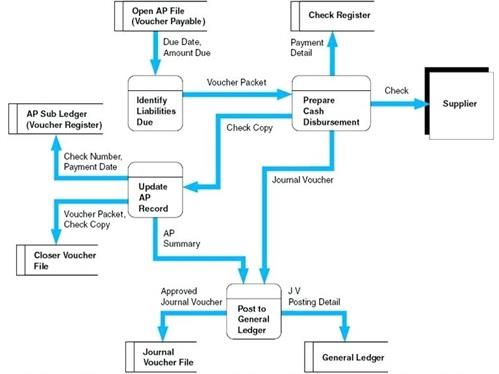

- System flowchart of cash disbursements system

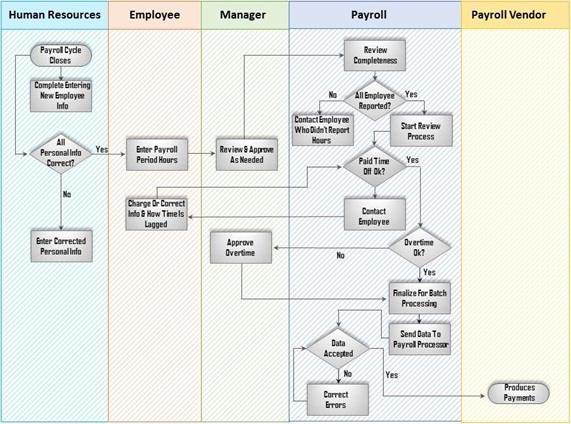

- System flowchart of payroll system

- Description of internal control weakness in each system and risks associated with the identified weakness

ORDER NEW COPY OF CASE STUDY - ADAM AND CO ASSIGNMENT & GET HIGH QUALITY SOLUTIONS FROM SUBJECT'S TUTORS!

Solution 1:

Executive Summary

The case highlights about the company Adam & Co., where the company has been working on the different industrial supplies. It has been working on the purchasing system along with focusing on the processes related to the centralized accounting system. There are different networking terminals which are set for the different locations and the paper is able to evaluate the expenditure cycle process in a proper manner. The three systems includes the expenditure cycle with the purchase of the system and the disbursement of the cash or the payroll system. We will be focusing on the planning for the conceptual patterns. The system flowchart is analyzed properly before the sections are used for discussing the weakness and the risks that are related to the system.

Introduction

The major objective for the expenditure cycle is mainly to work and enable the forms of conversion, where the company business cash and the human resources or the physical materials help in enhancing the different functions. The paper is based on the expenditure cycle for the purchase system, disbursement of the cash and payroll system for the Adam & Co., to highlight about the weakness and the system risks. The major focus is on enabling the CEO to properly evaluate the system and then determine about the procedures with internal controls and expenditures. Here, the focus is on planning about the purchases where the expenditure needs to be handled with the planning of system and then evaluate based on focusing on the expenditure cycle which is defined for the internal control patterns.

Flowchart for Purchase System

The system of purchase includes the evaluation of processing procedure where the composition factors involves the tasks that are relevant and then the fundamental factors involves the placing of order and then receiving inventories as well. The exchange of the identification and the other inventory needs is through revaluating the liabilities (Devan et al., 2015). The system involves the planning where the orders need to be worked upon along with properly reviewing the different relevant plans for the inventories. The focus has to be on handling the inventory standards which are receiving the commands from the clerk and then there is a reconciliation based on the digital order purchase. Here, the updates are set and defined for particular approach of accounting, where the transactions are processed through understanding the control account. The planning is defined through working over the invoice copy and then handling the purchase of orders which are important.

SAVE TOP GRADE USING CASE STUDY - ADAM AND CO ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM

Flowchart for Cash Disbursement System

Here, the accounts system is directly involved with handling the payable changes with focusing on the different departments which are involved through the company. It includes the sending and then receiving the data or the documents for the accounting cash. This helps in properly focusing over the maintaining of the documentation procedures. The planning needs to be done to properly evaluate the needs and then focus on the invoices that are defined for sending invoices for the vendors.

The planning is done through updates and the cheque is needed for the system of registration that will directly account for the handling of details of clear. The recording of the files and the invoices are defined with purchasing orders and receiving reports which are for the different copies of cheques as well. The updates are done for the cheque register and the accounting where the controlling of the accounts is important, and the information is completely depending upon how the details are received for the file recording procedures (Rozzani et al., 2016). The system details include the purchasing of the reports and the other cheque copies that are important for the working on the controlled measures and the records of the files. The cash disbursements includes the payments that needs to be taken to ensure about the company with satisfying the needs which are based on the notification and how the vendors are able to handle the effect cash management. The good internal controls are for the cash disbursement that can ensure about the payments which are done for the legitimate transactions. The accounts payable function is for the company vendor and the creditor transactions that help in approving the transactions for the different payments. The support of the documentation comes with the transactions that is made for handling and preventing any of the fraud or the invalid transactions (Gupta et al., 2017). The documentation is based on the cash disbursement where the invoice payments are set, and the example is related to the inventory that is purchased and the transactions which needs to have an invoice with the order purchase as well. For the service, the invoice needs to refer to the contractual details and the agreement related to the job that is set in between the parties. The documentation is important for handling the sign of the incomplete transactions like the products non-delivery of the services and then handling any fraud activities as well.

Flowchart for Payroll System

The focus is on how Adam & Co., is involved in handling the procedures for the different records, where there is a need to understand about the timecards procedures. The submissions are defined through the payroll departments where the updates are done through handling the system project control. The processing of the company data is when the employees are able to work with the proper procedures of distribution with working on the vouchers and the other manual forms. The focus is on preparing the vouchers which could be used for working with the payroll functioning and the departments are set to take hold of the accessible forms. The functions will involve the accountability and the payable forms which is set through depositing factors and then evaluating what needs to be done. The proper cheque is then filled with the accounting details and the payable department sectors. The payroll system is based on handling the employees with the establishing procedures that includes how it is possible to work with the consistent planning (Puspitasari et al., 2019). The payroll processing tends to create a huge burden with the unwanted stress that comes for the smaller owners of the business. The payroll system for the software designed company is to work on the tasks where the payment of the employees and the filing is important. It helps in keeping a proper track of the hours and then calculating or printing with the delivery checks or completing the direct deposits as well. The software requires the input from the employer where the input wage for the employee information and the software tends to make use of the information for calculating and deducting the withholdings. The automatic planning is about saving the money and then using the processing software. It works on the pay-as-you-go model where the purchasing estimates are for the keeping of information in-house. The consideration is about how the software is compatible and flexible where the importance is to work on the potential data breach and then handling benefits from automation. The other factor is to consider about the credibility of the system, where the vendors need to plan about payroll with understanding the potential existence for the malfunctioning and the other glitches. The new payroll system requires to handle the different standards which includes the salary payments and the withholdings of tax and deductions which are done from the paychecks.

DONT MISS YOUR CHANCE TO EXCEL IN CASE STUDY - ADAM AND CO ASSIGNMENT! HIRE TUTOR OF EXPERTSMINDS.COM FOR PERFECTLY WRITTEN CASE STUDY - ADAM AND CO ASSIGNMENT SOLUTIONS!

Internal Control Weakness and risks Associated

The weakness includes the problems with:

a. The purchasing of the clerk which is not under the authorized inventory.

b. Receiving the clerks who receive a complete blind copy of PO and this is not having any access for the slip of packing as well.

c. There are warehouse clerks who have no updates on the inventory and the subledger (Geerts et al., 2015).

d. There are AP clerks who do not tend to perform a three-way match. Here, the clerk is able to set a liability through the system based on PO and how the vendor invoice is able to handle the no receiving of the report.

The weakness also include the problems with the internal auditing control system where there are measures that needs to be taken for handling the policies and procedures. The assets include the premises where the equipment is defined for handling the planning and the recognition. The analysis is done for the preventive and the detective measures where the problems need to be handled with control loss.

Purchase System

The system has been involving the pressures which requires to be worked upon with controlled risks and then operating effectively or efficiently. The protection of the tangible and the intangible resources comes from the waste and the theft. The deficiencies are defined where the employee roles and the job responsibilities has to be worked upon. The deficiencies are related to the physical security and the roles and responsibilities. Here, the segregation is defined for handling the management and the approval from the owners. The regular with business performance reviewing the balancing the budgets and then checking on the earnings for target and then confirming with the goals, as met (Goeppinger et al., 2018). The reconciliations are defined for the different set of the data where the disaster recovery planning is to ensure the data planning and the asset protection to continue and then operate for the business which is damaged. The comprehensive policies and procedures are for the purchasing of the activities with working on the established policies and the regulatory measures. It is mainly to ensure about the internal controls that are implemented with limited exposure to any of the unauthorized or the inappropriate transactions. The issues are related to the overview and then planning about the development or the auditing testing to provide a better management objective that needs to be met properly.

GET ASSURED A++ GRADE IN EACH CASE STUDY - ADAM AND CO ASSIGNMENT ORDER - ORDER FOR ORIGINALLY WRITTEN SOLUTIONS!

Cash Disbursement System

The planning needs to be done for focusing over the accounting standards and then handling the cash flow which is needed to be worked upon with the bill payments. The avoidance is mapped through handling the excess cash which is related to protecting the assets and then defining it with segregation. The assigning of the values is based on how the employees work with focusing on the different assignments of the jobs. This is defined through handling the arrangements and the records are defined to be well-prepared. The disbursements are checked upon with approving and then recording the important practices where the clerks will have to handle the problems of refund as per the requirements (Sidlo et al., 2017).

Payroll System

The planning needs to be done to ensure about how the risks are defined and the processing is done. The schemes are worked upon with defining about the problems related to defrauding. The ERP planning is done to mainly plan about the analysis and the data sectors which will be important for the proper deep technology. The supervisors have to work on the different setup of the system practices and the procedures, where there are deeper technology standards. The software expertise is based on handling the different perspectives and the management of risk that could be for the internal control. It directly influences the perspectives for the management with handling the internal control that directly holds the different factors and procedures. This is worked upon through user education procedures (Herrera et al., 2015).

Conclusion

The analysis is based on the Adams & Co., where there are aspects that needs to be handled through planning the aspects and the procedures. It is based on working with the planning and the payroll systems that highlights on the system standards which works on the controlled optimization procedures (Moret et al., 2018). The processes is based on evaluating and then designing the ERP delivery standards that requires to test the system and the costs which is related to handle the controlling systems in an effective manner.

GET READYMADE CASE STUDY - ADAM AND CO ASSIGNMENT SOLUTIONS - 100% PLAGIARISM FREE WORK DOCUMENT AT NOMINAL CHARGES!

Solution 2 - Case Study- Adam and Co

1. Executive summary

The given report consists of three major sections including the introduction of the report, flowchart processes and finally the conclusion. The expenditure cycle of Adam and Co consist of three primary operations such as Purchases system, cash disbursement system and finally the payroll system. The digital purchases system if the company can face possible risks such as fraud, unapproved vendors,etc. Similarly, each system of the company can face a possible risk that may affect the overall operations and activities of the business. It is recommended that the internal control department should take corrective actions to mitigate possible risks.

2. Introduction of the report

An accounting information system is commonly referred to the structure which is used to collect, store and analyze the data inan effective way. The case study of Adam and Co demonstrate that Adam and Co is a company with wholesale industrial supplies. The company currently using centralized accounting system in daily operations. The given paper consists of an evaluation of the cash flow process, daily operations of Adam and Co. The paper basically consists of major sections. The body of the report contains the flow chart diagrams of each system that currently the company is using. The body of the paper also contains the possible risks associated with processes and the internal control for the expenditure cycle. The description of internal control weaknesses in each cycle and identification of associated risks for each system is the primary section of the report. After that based on identified risks, it would be discussed that what internal control system should do to mitigate the risks.

3. Body of the paper

3.1 Flowchart of the purchase system

Flowchart diagram

Processes

The purchase system diagram shows that the purchases system of the company consists of various steps. Such as, the purchasing clerk early morning checks the inventory ledger and check the daily inventory demand. If there is a shortage of inventory, the clerk places the order after selecting the right vendor. When the order submitted, the clerk prints out two copies of the purchase order and submit it to a receiving department. One copy is given to the receiving department and other is to vendor. Secondly, the recovering department receivesthe order and submit the copies to the A/P department for recoding the entry. Further, the A/P department receives the invoice reconcile the documents. At this time, the clerk updates the digital account payable subsidiary ledger and sends the invoices to cash disbursement department for further process. The whole process shows that the purchase system of Adam and Co is very significant. The purchasing process starts with the placement of the order and ends at A/P department.

MOST RELIABLE AND TRUSTWORTHY CASE STUDY - ADAM AND CO ASSIGNMENT HELP & HOMEWORK WRITING SERVICES AT YOUR DOORSTEPS!

Risks associated

Commonly, the digital purchase system has various risks associated with. Although, the digital purchase system is easy and cost-effectivebut there are some risks that affect the overall purchase system (Wolske, et al., 2017).

One of the primary risk associated with digital purchase system is the quality of the product. As the order placed digital,therefore, the vendor does not know what actually the quality of the product is. The vendor can deliver less quality ofthe product in this case. Therefore, the quality of the products or inventory is the biggest risk that the purchase system can face.

Secondly, the delivery risk is another important and significant risk associated with digital purchase system (Brindley, 2017). It could be possible that the vendor places the order at the wrong place. It overall affects the digital purchasing system and planning phase. Moreover, other associated risks with purchases system could be the identification of the vendor. The vendor should be approved and trustworthy man. It could be possible that the purchasing clerk places the order to the unapproved clerk and the vendor deliver the low quality of products.

Internal control

In order to prevent risky situations, the internal control system/ department of the company should take corrective actions. The purchasing system should select and place orders to approve vendors. It is the primary responsibility of the internal control system to select and place the order to approved vendors so that they cannot face a risk of fraud (Kerzner, 2017). Moreover, the internal control system should take corrective measures to mitigate the risk of a trustworthy vendor. It could be possible that the vendor placesless quality of products. Here, when the order received in the receiving department, it is the primary responsibility of the receiving department to check and analyze the quality of the products. Further, the control system can also mitigate the risk by use of transaction authorization system to identify the inventory need and requirement. This will help to analyze the inventory needs at the right time.

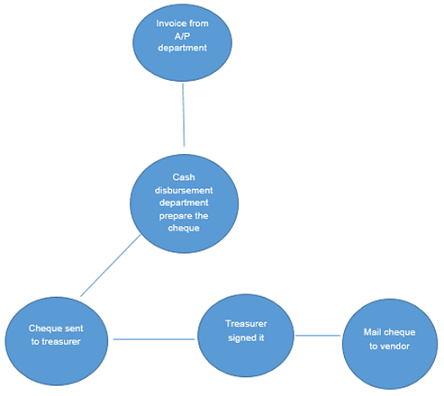

3.2 Cash flow chart of cash disbursement system

Flowchart diagram

Processes

The above flowchart diagram shows that the cash disbursement system of the company also consists of various processes and steps. The activities start when the order is placed by the purchases system to a vendor. The account payable department send the invoices to cash disbursement department, and the cash disbursement department checks the due date. On the due date, the clerk of cash disbursement department made a cheque and send it to the treasurer. Finally, the treasurer then sends the invoices, files and send the copy of the cheque to receiving department.

The flowchart diagram shows the entire process in different steps. The flow chart diagram clearly shows thatthe cash disbursement department has a primary duty to disburse the cash and made the payments after the signature of treasurer.

SAVE DISTINCTION MARKS IN EACH CASE STUDY - ADAM AND CO ASSIGNMENT WHICH IS WRITTEN BY OUR PROFESSIONAL WRITER!

Risks

The cash disbursement department is responsible to check the payments with correct amounts and authorization (Vasudha, et al., 2017). One of the biggest risk that cash disbursement department can face is invalid payments or incorrect amount. It could be possible that the chequecontainsan incorrect amount to pay. This can affect the whole cash disbursement operations and activities.

Secondly, the authorization of the cheque and the total amount is another possible risk. The approval of a cash disbursement transaction is prior to preparing the cheque. The authorization should be made by the board of directors of the company. Moreover, another primary risk associated with cash disbursement is doing the payment on the due date. It could be possible that the cash disbursement officer forgets to do the payment on due date due. The misunderstanding could be one of the primary risks during the cash disbursement process. Moreover, after signing the cheque and payment made, the cash disbursement officer update cheque register sheet. All of these risks are significantly associated with each other. In case, if the cash disbursement officer fails to do the payment on the due date and an issue of fraud arise. Therefore, the internal control department should take corrective actions to minimize these possible risks.

Internal control measures

In order to minimize the possible risks associated with cash disbursement activities, the internal control system should take corrective measures (Francis & Imiete, 2018). For instance, in order to minimize the risk of authorization, there should be a double signature on the cheque. It has already discussed above that designated members of management should be given responsibility for authorization of actual payments. The cash disbursement officer can mitigate the risk of fraud by dual signature upon a cheque. The dual signature policy will help to avoid the risk of authorization and it further helps to avoid from any risk of fraud.

As it already mentions above the payment on the due date is also the biggest risk that cash disbursement department can face. In order to mitigate this risk, the internal control system should be focused on a reminder to do the payment on the due date. Such as, the cash officer should identify and analyze the due date payment and should do the payment on that date. Moreover, one of the effectiveways to mitigate this risk is the segregation of duties. It means that all financial and operational transactions should not be handled by only one person from beginning to end. There must be segregation of duties by the different people to authorize the checks, payments in books, sign cheques as well as bank reconciliation (Jahan, 2016). This strategy will help to mitigate the overall risks associated with cash disbursement department.

HIRE PROFESSIONAL WRITER FROM EXPERTSMINDS.COM AND GET BEST QUALITY CASE STUDY - ADAM AND CO ASSIGNMENT HELP AND HOMEWORK WRITING SERVICES!

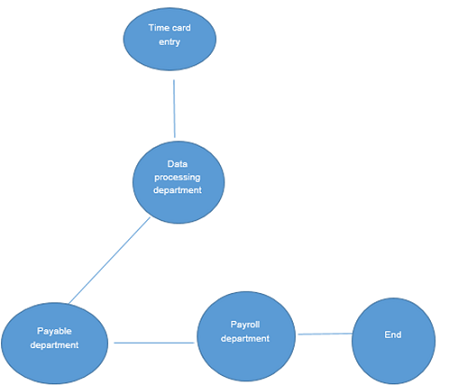

3.3 Cash flow chart of payroll system

The payroll system is the key department in every organization. Commonly, the payroll department in an organization identifies and calculate the amount owes to an employee. It analyzes how much amount an employee earns against the working hour.

Flowchart diagram

Processes

The above flowchart diagram shows that the payroll system in an organization refers tothe processing and task of managing the payments of wages to its employees. The payroll system in Adam and Co processes through time card data entry. The workers of the company record their daily working hours on the time cards. The supervisors on a daily basis check and analyze the entries on time card and identify the payroll system. After that, the details send to the data processing department. The data processing department then analyze the details and send it to the payable department. The payable department further sends the details to payroll systems and the process ends. The details, salaries or wages sends to the payroll department to record it on payroll register.

Possible risks

The payroll system can face various possible risks. One of the primary and biggest risks under the payroll system is incorrect processing of payroll by mistake (Hashem, et al., 2015). It means that the employees can make un authorization modifications to the payroll database. It could be possible that employees put incorrect details during the payroll entry. Some of these can be intentional or some could be true mistakes. Therefore, this is one of the important risk associated with the payroll system.

Another biggest risk associated with payroll system is miscalculations. The improper calculations could be lack of verifications of the bills that lead to excessive payments. The miscalculations also contain also contains the reimbursement claims made on the basis on the improper bills.

Lack of security is another primary risk associated with the payroll system. The lack of security affects the different activities and operations such as identify theft, falsifying documents for personal gain. For a company, the most common risk is to have one person who is responsible for payroll. Finally, the most significant risk associated with the payroll system is the breach and data loss activity because the payroll system details placed in the system.

WE HELP STUDENTS TO IMPROVE THEIR GRADES! AVAIL TOP QUALITY CASE STUDY - ADAM AND CO ASSIGNMENT HELP AND HOMEWORK WRITING SERVICES AT CHEAPER RATE!

Internal control measures

In order to mitigate the risks of the payroll system, the internal control system can require a outsource payroll solution. The outsource payroll can be helpful to initiate the other benefits like improving the direct deposit enrollment. It is less time consuming as well as a cost-effective solution to solve the payroll system problem.

Secondly, the above possible risks can be mitigated through improving the internal control system of the organization as well as formed new policies. This will help Adam and Co to detect instant fraud and allow a platform for training. The data saved in systems, therefore there is possible that data may theft or loss. In order to prevent this situation, the internal control system should be set and change passwords on a weekly basis. This type of risk can be prevented through backup data facility. The data not only save in system but also be saved in another hard drive. This will help to decrease the data loss risk and will prevent the disaster situation.

4. Conclusion

Adam and Co is a Perth based wholesaler of industrial supplies. The case study facts explain that the company is currently using the centralized accounting system. The expenditure cycle of the company consists of three major operatingsystems such as purchases system, cash disbursement system and payroll system. The flowchart diagrams of each system have explained the overall process, possible risks and internal control measures of the company. Mainly, each system facing some of eth risks due to weaknesses in the internal control system. Therefore, it is advised that the organization should be focused on strengthening the internal control system. The identification of possible risks and its mitigation has discussed in detail.

HIRE PROFESSIONAL WRITER FROM EXPERTSMINDS.COM AND GET BEST QUALITY CASE STUDY - ADAM AND CO ASSIGNMENT HELP AND HOMEWORK WRITING SERVICES!

Listed below some of the major courses cover under our Holmes Institute Assignment Help Service:-

- HA2032 - Corporate & Financial Accounting Assignment Help

- HC1072 - Economics & International Trade Assignment Help

- HC1010 - Accounting for Business Assignment Help

- HA1020 - Accounting Principles & Practices Assignment Help

- HA3021 - Corporations Law Assignment Help

- HA3042 - Taxation Law Assignment Help

- HC2121 - Comparative Business Ethics and Social Responsibility Assignment Help

- HA2022 - Business Law Assignment Help

- HA1022 - Principles of Financial Management Assignment Help

- HA1011 - Applied Quantitative Methods Assignment Help

- HC2091 - Business Finance Assignment Help