SAVE DISTINCTION MARKS IN EACH BASIC TREASURY FUNCTION AND TREASURY MANAGEMENT ASSIGNMENT WHICH IS WRITTEN BY OUR PROFESSIONAL WRITER!

Basic Treasury Function and Treasury Management

Question: List and explain the basic treasury management issues and their historical trend over five years.

Solution:

Basic Treasury Function and Treasury Management Issues

The present report outlinesthe basic treasury function and treasury management issues taking case example of Commonwealth Bank, Australia. The primary objective of the treasury department is to control the liquidity of the business. In simple terms, it monitors the current and projected cash inflows and outflows for ensuring the company holds sufficient cash required to evaluate business operations. The basic treasury functions of Commonwealth Bank arebased on the level of their importance include cash forecasting, monitoring working capital, centralizing cash in an investment account, allocating investment, grant credit, fundraising, risk management, bank relationship, and margarine acquisitions (Page, 2017).

Based on the report of 2017 Global Corporate Treasury Survey, the common treasury management issues observed over the past five years are FX volatility (52%), visibility into global operations (43%), cash repatriation (40%), liquidity (39%), managing in restricted market (31%), inadequate Treasury system infrastructure (30%), global tax reform impact (24%), leverage (22%), treasury operation cost (12%), lack of understanding in management (10%), and ability to respond to the board (9%) (Levich, 2017). However, to serious treasury management issues identified in Commonwealth Bank are 1) payment and cyber fraud, 2) lack of effective risk management.

Question a. Identify two major area of treasury management

Solution:

Payment and cyber fraud

Payment and investment are one of the critical areas of treasury management. Cyber fraud has now become a serious threat for the treasury managers of Commonwealth Bank. Through payment fraud, cybercriminals often target the treasury department to fulfil their evil motive of financial gain. Based on the survey report of Global Corporate, 40% of respondents identified themselves to be the target of cyber fraud in the recent (Kelly, 2017). Apart from payment fraud, the company is also targeted for check fraud, which started to increase since 2016.

GET ASSURED A++ GRADE IN EACH BASIC TREASURY FUNCTION AND TREASURY MANAGEMENT ASSIGNMENT ORDER - ORDER FOR ORIGINALLY WRITTEN SOLUTIONS!

Question b. Identify the current practices of managing the two treasury management areas over last five years

Solution:

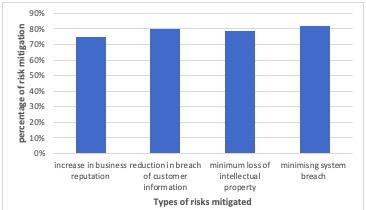

In response to the treasury management issue, the company started to improve its treasury management system and upgraded its internal security system. Furthermore, review internal control and governance activities. In addition to this, it had also implemented a regular training program for its treasury manager. Doing so, theyachieve the basic understanding of the operations of cyber criminals and implementing effective fraud prevention countermeasures against it. With the use of these current practices, the company is able to achieve considerable improvement, which is evident from the following graph.

Fig 1. Improvement in mitigating potential risks associated with the issue

Question c. Identify the chain of responsibility of interims of who is responsible for those functions.

Solution:

The chain of responsibility of interim for the issue cybercriminals who aim at stealing billions of dollars of the company and consumers in a single year.

Question d. Identify the potential sources of risk in the management of those two functions.

Solution:

The potential risk associated with cyber fraud is a financial loss (for customers and company), leak of customer's financial details, negative brand image, and loss in customer base.

Question e. Identify the current practices of managing the risk (governance of the risk) in those two areas.

Solution:

In order to minimize these risks, the Commonwealth Bank uses practices such as firewall installation in the computers, not responding to suspicious emails, restricting administrative rate for installing programs to IT staff, and monitoring the use of all computer business-related work (Kelly, 2017).

Question f. Suggest any improvement with details supporting calculations.

Solution:

The existing security aspect of Commonwealth Bank can be improved by following strategies:

Governance- effective security and regular evaluation will overall reduce 30% of fraudulent activities

Risk assessment - It can also reduce fraud approximately 40% in internet payment.

Incident report - any suspicious issue should be reported to the authorities which can again minimise 20% of potential threat

Thus, these approaches can reduce (30%+40%+20%) = 90% of cyber fraud in bank payments.

ORDER NEW BASIC TREASURY FUNCTION AND TREASURY MANAGEMENT ASSIGNMENT AT NOMINAL PRICE!

Lack of effective Risk management

The treasury risk management area of Commonwealth Bank is basically concerned with financial Risk management and financial supply chain management.

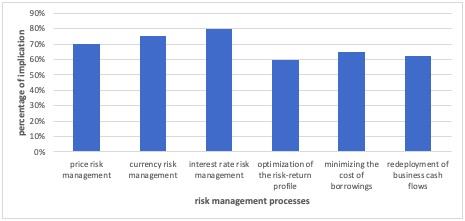

Financial Risk management is involved in practices such as commodity price risk management, currency risk management, and interest rate risk management. This practices how to keep the business margin of bank insulator from the market volatility. While the supply chain management is involved in the practice of minimizing the cost of borrowings, redeployment of business cash flows, and optimization of the risk-return profile (DeAngelo, & Stulz, 2015).

Fig 2. Various practices of the risk management area

The treasury managers and internal audit of the bank are responsible for effective conductance of these functions.

There are some potential risks associated in the risk management area of Treasury management such as unable to quantify the cost of risk and misunderstanding critical risk.

Thus, to manage these risks Commonwealth Bank has implemented an effective strategic plan. For accurate quantification of risk cost, it has developed a costing framework that aggregates both fixed and variable cost, which can effectively manage the risk portfolio. Furthermore, to understand the importance of risk, it has prioritized the potential issues on the basis of operational and financial risk.

The improvement in the Risk management area of Commonwealth Bank is reflective in the increase of PEARL X value to almost $1.4 billion in the last year (McIlroy, 2017). Thus, in order to achieve an effective risk management strategy, Commonwealth Bank can implement the following calculation model to evaluate value at risk (VaR)

P ((min?{x1,...xn}-bn)/an≤x) = G(x) with n → ∞, here {an} and {bn}are numerical sequences and P is correlation coefficient

This VaR approach can determine operational and market risk.

GET GUARANTEED SATISFACTION OR MONEY BACK UNDER BASIC TREASURY FUNCTION AND TREASURY MANAGEMENT ASSIGNMENT HELP SERVICES OF EXPERTSMINDS.COM - ORDER TODAY NEW COPY OF THIS ASSIGNMENT!