Assignment - Analysis of Financial Accounts

You must choose a UK listed PLC from the FTSE - 100 List. (InterContinental Hotels or IHG) You must also find a suitable competitor company (preferably of similar size) to enable valid comparisons of performance to be made.

ORDER NEW ANALYSIS OF FINANCIAL STATEMENTS ASSIGNMENT AT NOMINAL PRICE!

Answer - Analysis of Financial Statements

Executive Summary

The paper is an financial perspective and stock analysis of the two companies which being the Millennium & Copthorne Hotels PLC MLC and the InterContinental Hotels PLC. Thus, the paper is an comparative analysis of the two organisation dealing in the same industry.

1. A brief introduction to the company, the nature of its business and a brief overview of its financial performance and position over the past five years.

Introduction

InterContinental Hotels

Nature: - It is a British owned multinational hospitality organisation having its headquartered in Denham, Buckinghamshire, England. Being a public limited company came into existence back in 1777, however the major established is made in the year 2003 (IHG, 2018).

Overview of the financial review:- On a perspective of a five-year analysis the company on larger basis shows a stable position which is showing a mix trend in terms with revenue as well as the profit analysis. Majorly because though the company is still producing profits. Its operating expense is still to be analyzed as it showing a major difference on account with each year analysis. The same understanding is on account with the cash flow as the in 2015 the company had a high range of the cash balance which actually provided a negative balance in 2016 which the organisation has gradually nullified till financial year 2018.

Millennium & Copthorne Hotels PLC

Nature: - It is a British owned multinational hospitality organisation along with a real estate business having its headquartered in London England. Being a public limited company came into existence back in 1972 (MLC, 2018).

Overview of the financial review:- The company proves to be stable in terms with the financial prospects, here the company is proving to be a balanced format in terms with the sales growth as well as the profit margin along with the operating expenses. On the more, the dividend and the earning price per share is as well stable along with the dividend is promising proving the company is much stable in financial position.

GET BENEFITTED WITH QUALITY ANALYSIS OF FINANCIAL STATEMENTS ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM!

2. Compare the financial performance of your company and a suitable competitor using a minimum of 10 ratios over the last 2 financial years. Your analysis should cover profitability, liquidity, efficiency and capital structure ratios.

Analysis on Financial Ratio

The Table for 10 financial ratio for two years is stated in the appendix as well below

|

Company

|

IHG

|

|

MLC

|

|

|

Liquidity Ratio

|

Financial Year

|

2017

|

2018

|

2017

|

2018

|

|

Current Ratio

|

0.67

|

1

|

1.3

|

1.07

|

|

Quick Ratio

|

0.56

|

0.9

|

0.99

|

0.85

|

|

|

|

|

|

|

|

Profitability Ratio

|

|

|

|

|

|

|

Net Profit

|

13.25

|

8.093

|

12.3

|

4.31

|

|

Gross Profit

|

86.99

|

83.72

|

57.24

|

56.27

|

|

|

|

|

|

|

|

Efficiency Ratio

|

|

|

|

|

|

|

Inventory Turnover

|

190.33

|

141.2

|

4.42

|

4.02

|

|

Assets Turnover

|

1.36

|

1.56

|

0.32

|

0.32

|

|

|

|

|

|

|

|

Capital Structure Ratio

|

|

|

|

|

|

|

Equity/ Debt Ratio

|

-2.08

|

-1.55

|

0.3

|

0.28

|

|

Times Interest Ratio

|

8.62

|

6.99

|

6.64

|

4.79

|

|

|

|

|

|

|

|

Market Value Ratio

|

|

|

|

|

|

|

P/E Ratio

|

28.7

|

17.8

|

17.1

|

19

|

|

Market Book Ratio

|

-10.9

|

-8.8

|

0.7

|

0.6

|

|

|

|

|

|

|

ORDER NEW COPY OF ANALYSIS OF FINANCIAL STATEMENTS ASSIGNMENT & GET HIGH QUALITY SOLUTIONS FROM SUBJECT'S TUTORS!

The Ratios are explained as below:-

Profitability Ratio

In terms with the ratio prospect where the profits deals with analysis where the margin analysis where the both the organisation has seen a massive variance in terms with the gross margin as well as the net margin. The downfall has decreased in terms and slipped with major points analysis it is due to the fact that the company leads to provide a non balance ratio in terms with the operating expenses and the expense ratio analysis(IHG, 2018) (MLC, 2018). The other reason as to why the profits show a downfall where the revenue is being controlled is that of the fact where the debt has been paid showing that the equity is controlled to a much-balanced level.

Liquidity Ratio

In terms with liquidity perspective any ratio which is above 1 or a quick ratio which is nearing one is supposed to lead to a substantial level of understanding on account with paying of the assets with the liabilities on account with the day to day activities. In terms with the perspective where and comparing both the organisation it is evident that the ratio of the organisation are doing fairly level and are in much balanced condition. As both the competitors ensure that the pay off the charges are well placed. In terms with ratio comparison the IHG is doing much better as compared to the MLC.

Efficiency Ratio

The analysis in connection with the efficiency parameters in terms with the inventory and the assets in context to the sales basis deals with a margin prospect. Both the organisation is performing much stable in terms with the sales and revenues. It leads to condition where the turnover where the Assets and the Inventory leads to a balance where the sales and the profits are considered in terms with how they are managing (IHG, 2018) (MLC, 2018). The ratio clearly provides that the IHG is much more effective and balanced in comparison to the MLC as the stocks and the fixed assets of the company are correctly and appropriately managed and leads to prospective results.

Capital Structure Ratio

The owners fund and the borrowed fund are marked on context to the fact that the how are two aspects balancing one being the debt equity ratio and the other being the interest payout ratio. The same is un comparable on respective of the fact that the former which being the IHG is only equity based as compared to the other where the organisation still has a debt balanced though being less than 1 still leads to a significance.

Market Value Ratio

The Ratio leads to analysis defining the market position of the company where the both the competitors are balancing on account with the market position. The condition proves that IHG is showing a prospect image on market conditions where the ratio is much promising and progressive on forefront.

SAVE TOP GRADE USING ANALYSIS OF FINANCIAL STATEMENTS ASSIGNMENT HELP SERVICE OF EXPERTSMINDS.COM!

3. Comment on the business from an investor's point of view in terms of movements in share price and investor ratios and compare your business to the Stock Market performance over the past year.

Analysis on Stock Market Performance

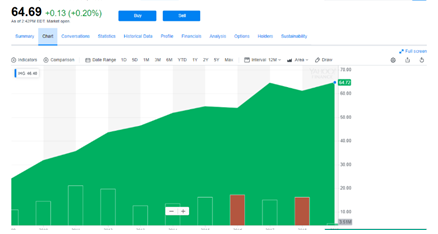

InterContinental Hotels

The share analysis and the stock prices for a five-year period provides a very clear picture in concept with the fact that the shares of the company are constantly moving on an upward trend. Here, the company is showing a promising return in terms with the dividend as well as the stock value. Hence, the recommendation is mainly to either hold the shares or buy thus, proving to be apt for investment.

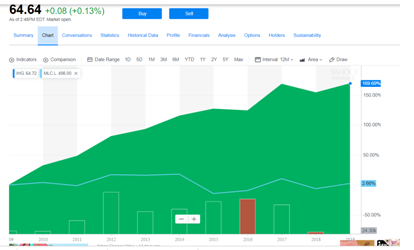

Millennium & Copthorne Hotels PLC

The share analysis and the stock prices for a five-year period provides a very clear picture in concept with the fact that the shares of the company are constantly proving a mix trend. Hence, the recommendation is mainly to either hold the shares or sell the shares thus, proving to be apt for investment.

Here the green area provides the share rate of the IHC hotels and the Blue line provides the share analysis of the Millennium & Copthorne Hotels plc.

4. Review any changes in accounting policies impacting on the performance of your chosen company and the comparative company.

Analysis on change in Accounting Policies

The organisation IHG in both the financial year which being the 2017 and 2018 has seen a change in terms with the accounting standards in regards with the fund revenues and occurrence the company has gone through a change in terms with the adoption of IFRS 15 - Revenue from Contracts with Customers. The other change is which is prospective is the paragraphs 30 and 31 of IAS 8 'Accounting Policies, Changes in Accounting Estimates and Errors (IHG, 2018).

Considering the Millennium & Copthorne Hotels plc reports the company at present have not led to any major changes with respect to the accounting policies and the pratices. It leads to a provide clearly that the company is actually abiding the standards laid by the accounting board in the same manner as provided (MLC, 2018). On the more, in its annual reports it clearly specifies that any changes made in the practicing policies and standards made by the professional board will be also followed by the company as well and will be done as the same manner prescribed by the regulations.

DO YOU WANT TO EXCEL IN ANALYSIS OF FINANCIAL STATEMENTS ASSIGNMENT - ORDER AT EXPERTSMINDS!

5. Consider the limitations of your analysis and any reservations that you may have about the analysis that you have provided. Guidance You are advised to keep records of share price movements and keep abreast of business news about your company to explain any impact on capital and financial markets and perceived performance of your company.

Limitation on Analysis

The limitation is primarily on account with the aspect where the figures taken and analyzed in context with the financial ratio as well as the stock performance is pre stated and on basis of that the reflection is done. Henceforth, the drawback is mainly on account with the secondary research on data. Thus, the limitation includes the concept of the assumption perspective in terms with the monetary figures and the financial information provided on the company website are considered appropriate without taking any further research.

Conclusion

The paper is a critical preview of various elements which basically concentrates in terms with the financial and the market condition. It provides a review as to how the organisation of the same business performs on year span of two to five years and also relates in terms with market standing It is purely based on the perspective and understanding of financial terms and concepts.

DON'T MISS YOUR CHANCE TO EXCEL IN ANALYSIS OF FINANCIAL STATEMENTS ASSIGNMENT! HIRE TUTOR OF EXPERTSMINDS.COM FOR PERFECTLY WRITTEN ANALYSIS OF FINANCIAL STATEMENTS ASSIGNMENT SOLUTIONS!