ACCT615 - Individual Tax Research and Planning Assignment - Taxation Questions, American Public University, USA

GET READYMADE ACCT615 - INDIVIDUAL TAX RESEARCH AND PLANNING ASSIGNMENT SOLUTIONS - 100% PLAGIARISM FREE WORK DOCUMENT AT NOMINAL CHARGES!

Question 1 - a. Determine Jeremy's tax refund or taxes due.

|

Description

|

Amount

|

|

(1)

|

Gross Income

|

$109,000

|

|

(2)

|

For AGI deductions

|

$0

|

|

(3)

|

Adjusted gross income

|

$109,000

|

|

(4)

|

Standard deduction

|

$18,000

|

|

(5)

|

Itemized deductions

|

$29,700

|

|

(6)

|

Greater of standard deduction or itemized deductions

|

$29,700

|

|

(7)

|

Taxable income

|

$79,300

|

|

(8)

|

Income tax liability

|

$11,994

|

|

(9)

|

Child tax credit -

|

2000

|

|

(10)

|

Tax withheld

|

$11,200

|

|

(11)

|

Tax due

|

$794

|

Workings: Gross Income = salary and interest income = $101,500 + $7,500 = $109,000

Taxable income = Adjusted gross income - Itemized deductions = $109,000 - $29,700 = $79,300

Income tax liability = $5,944+22%×($79,300-$51,800) = $11,994

Tax due = $11,994 - $11,200 = $794

Schedule Z-Head of Household

|

If taxable income is over:

|

But not over:

|

The tax is:

|

|

$ 0

|

$ 13,600

|

10% of taxable income

|

|

$ 13,600

|

$ 51,800

|

$1,360 plus 12% of the excess over $13,600

|

|

$ 51,800

|

$ 82,500

|

$5,944 plus 22% of the excess over $51,800

|

|

$ 82,500

|

$157,500

|

$12,698 plus 24% of the excess over $82,500

|

|

$157,500

|

$200,000

|

$30,698 plus 32% of the excess over $157,500

|

|

$200,000

|

$500,000

|

$44,298 plus 35% of the excess over $200,000

|

|

$500,000

|

-

|

$149,298 plus 37% of the excess over $500,000

|

MOST RELIABLE AND TRUSTWORTHY ACCT615 - INDIVIDUAL TAX RESEARCH AND PLANNING ASSIGNMENT HELP & HOMEWORK WRITING SERVICES AT YOUR DOORSTEPS!

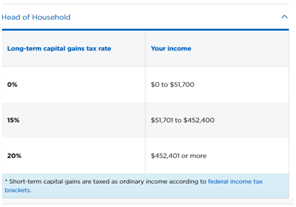

b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $11,050. What is Jeremy's tax refund or tax due including the tax on the capital gain?

|

Description

|

Amount

|

|

(1)

|

Gross Income

|

$120,050

|

|

(2)

|

For AGI deductions

|

$0

|

|

(3)

|

Adjusted gross income

|

$120,050

|

|

(4)

|

Standard deduction

|

$18,000

|

|

(5)

|

Itemized deductions

|

$29,700

|

|

(6)

|

Greater of standard deduction or itemized deductions

|

$29,700

|

|

(7)

|

Taxable income

|

$90,350

|

|

(8)

|

Income tax liability

|

$13,652

|

|

(9)

|

Child tax credit

|

$0

|

|

(10)

|

Tax withheld

|

$11,200

|

|

(11)

|

Tax due

|

$2,452

|

Workings: Gross Income = salary and interest income + Long term capital gain = $101,500 + $7,500 +$11,050 = $120,050

Taxable income = Adjusted gross income - Itemized deductions = $120,050 - $29,700 = $90,350

Income tax liability = $5,944+22%×($79,300-$51,800) + $11,050×15% = $11,994 + $1,658 = $13,652

Tax due = $13,652 - $11,200 = $2,452

c. Assume the original facts except that Jeremy had only $7,000 in itemized deductions. What is Jeremy's tax refund or tax due?

|

Description

|

Amount

|

|

(1)

|

Gross Income

|

$109,000

|

|

(2)

|

For AGI deductions

|

$0

|

|

(3)

|

Adjusted gross income

|

$109,000

|

|

(4)

|

Standard deduction

|

$18,000

|

|

(5)

|

Itemized deductions

|

$7,000

|

|

(6)

|

Greater of standard deduction or itemized deductions

|

$18,000

|

|

(7)

|

Taxable income

|

$91,000

|

|

(8)

|

Income tax liability

|

$14,738

|

|

(9)

|

Child tax credit

|

$0

|

|

(10)

|

Tax withheld

|

$11,200

|

|

(11)

|

Tax due

|

$3,538

|

Workings: Gross Income = salary and interest income = $101,500 + $7,500 = $109,000

Taxable income = Adjusted gross income - Standard deduction = $109,000 - $18,000 = $91,000

Income tax liability = $12,968+24%×($91,000-$82,500) = $14,738

Tax due = $14,738 - $11,200 = $3,538

SAVE DISTINCTION MARKS IN EACH ACCT615 - INDIVIDUAL TAX RESEARCH AND PLANNING ASSIGNMENT WHICH IS WRITTEN BY OUR PROFESSIONAL WRITER!

Question 2 - a. What is the amount of Rick's after-tax compensation (ignore payroll taxes)?

|

Description

|

Amount

|

|

(1)

|

Gross Income

|

$141,800

|

|

(2)

|

For AGI deductions

|

$0

|

|

(3)

|

Adjusted gross income

|

$141,800

|

|

(4)

|

Standard deduction

|

$12,000

|

|

(5)

|

Taxable income

|

$129,800

|

|

(6)

|

Income tax liability

|

$25,442

|

|

(7)

|

After tax compensation

|

$104,359

|

Workings: Taxable income = Adjusted gross income - Standard deduction = $141,800- $12,000 = $129,800

Income tax liability = $14089.5 +24%*($129,800-82500)= $25,442

After tax compensation = $129,800 - $25,442 = $104,359

b-1. Suppose Rick receives a competing job offer of $134,000 in cash compensation and nontaxable (excluded) benefits worth $7,800. What is the amount of Rick's after-tax compensation for the competing offer?

|

Description

|

Amount

|

|

(1)

|

Gross Income

|

$134,000

|

|

(2)

|

For AGI deductions

|

$0

|

|

(3)

|

Adjusted gross income

|

$134,000

|

|

(4)

|

Standard deduction

|

$12,000

|

|

(5)

|

Taxable income

|

$122,000

|

|

(6)

|

Income tax liability

|

$23,570

|

|

(7)

|

After tax compensation

|

$98,431

|

Workings: Taxable income = Adjusted gross income - Standard deduction = $134,000- $12,000 = $122,000

Income tax liability = $14089.5 +24%*($122,000-82500)= $23,570

After tax compensation = $134,000 - $23,570 = $98,431

HIRE PROFESSIONAL WRITER FROM EXPERTSMINDS.COM AND GET BEST QUALITY ACCT615 - INDIVIDUAL TAX RESEARCH AND PLANNING ASSIGNMENT HELP AND HOMEWORK WRITING SERVICES!

b-2. Which job should he take if taxes are the only concern?

Landscape consultant

As it has less taxable income as compared to taxable income in Compensation job due higher cash payment.

Question 3 - Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions.

|

Description

|

Engagement 1

|

Engagement 2

|

|

(1)

|

Gross Income before new work engagement

|

$95,000

|

$95,000

|

|

(2)

|

Income from engagement

|

$8,580

|

$9,750

|

|

(3)

|

Additional for AGI deduction

|

$4,400

|

|

|

(4)

|

Adjusted gross income

|

$99,180

|

$104,750

|

|

(5)

|

Greater of itemized deductions or standard deduction

|

$12,000

|

$12,000

|

|

(6)

|

Deduction for QBI

|

|

$1,950

|

|

(7)

|

Taxable income

|

$87,180

|

$92,750

|

Deduction for QBI = 20%×$9,750 = $1,950

WE HELP STUDENTS TO IMPROVE THEIR GRADES! AVAIL TOP QUALITY ACCT615 - INDIVIDUAL TAX RESEARCH AND PLANNING ASSIGNMENT HELP AND HOMEWORK WRITING SERVICES AT CHEAPER RATE!

Question 4 - a-1. Strictly considering tax factors, should Nitai work or repair his car if the $234 he must pay to have his car fixed is not deductible?

a-2. Given the answer in a-1 above, by how much is Nitai better or worse off?

If Nitai work,

Taxable income = $325

Tax liability = $325×12% = $39

Net Receipt = $325-$39 = $286

If Nitai repair,

He earns $234 by saving the same for repair work payment to Autofix.

a-1) Therefore, Nitai should work.

a-2) Nitai will be better of $52 ($286-$234).

Question 5 - a. What amount of tax can the IRS require Jasper to pay for the Dahvill's year 2 joint return?

Amount of TAX will be $6,800.

As both Jasper and Crewella Dahvill are liable for tax jointly and severally for joint return fillings for year 2.

b. What amount of tax can the IRS require Jasper to pay for Crewella's year 3 separate tax return?

Amount of TAX will be $0.

Jasper is not liable for tax payment because Crewella Dahvill filled return as single status for year 3.

NEVER MISS YOUR CHANCE TO EXCEL IN ACCT615 - INDIVIDUAL TAX RESEARCH AND PLANNING ASSIGNMENT! AVAIL AFFORDABLE AND RELIABLE ACCT615 - INDIVIDUAL TAX RESEARCH AND PLANNING ASSIGNMENTS HELP SERVICES OF EXPERTSMINDS.COM!

Access our American Public University Assignment Help Services for its related academic units such as:-

- ACCT610 - Advanced Accounting Assignment Help

- ACCT100 Accounting Assignment Help

- ACCT499 Senior Seminar in Accounting Assignment Help

- ACCT301 Intermediate Accounting Assignment Help

- ACCT400 Auditing Assignment Help

- ACCT401 Cost Accounting Assignment Help

- ACCT420 Individual Federal Taxes Assignment Help

- ACCT202 Introduction to Payroll Assignment Help

- ACCT300 Financial Accounting Assignment Help

- ACCT305 Accounting Information Systems Assignment Help

- ACCT406 Managerial/Cost Accounting Assignment Help

- ACCT410 Governmental and Not-for-Profit Accounting Assignment Help

- ACCT415 Law for Accountants Assignment Help