Accounting Proposal Assignment Help

Topic : What are the challenges presented by Fair Value Measurements to external audits in United Kingdom?

a) Identify a research topic, develop aims and objectives justified through reference to approriate literature.

b) Critically analyse a wide range of literature in accounting and finance.

c) Synthesise and critique the different methodological frameworks that influence research to inform and justify a research methodology.

d) Collect, analyse and interpret data in the context of existing literature.

e) Develop independent working and project management skills.

f) Initiate a reflective and independent approach to learning in managing an extended project.

g) Communicate information and present complex arguments, clearly and accurately in a manner suited to an academic audience.

Getting Stuck with Similar Assignment? Enrol with Expertsmind's Accounting Proposal Assignment Help services and Get distressed with your assignment worries!

Introduction

Accounting is the crucial and the important part of an organisation as it provides the organisation with the finances description and management. The management of finances and the control of it plays a vital role in the organisation as finance is the base of any organisation. There are multiple tools and techniques for recording and maintaining the finances which provides the organisation with accurate information as and when required. All the other activities and decisions if the organisation is dependent on this department. Fair Value Measurement is among the tools utilised for valuing the assets and liabilities of the organisation and thus, it frames up to be an important part of the accounting department. The research has a purpose of exploring the challenges that is present in the fair value measurement to the external audits in United Kingdom (Macve, 2015). The tools like the fair value measurement provides the auditors with a helping and supporting criteria which is accompanied by some challenges too. The research would provide with some accurate challenges that is faced in the execution of fair value measurement and the respective solutions would also be provided which would make the research productive and applicable. The research would be conducted on a wide scale but if it considers the challenges on a global level hen the research would have been much more acceptable.

Background of the Research

Fair Value Measurement is among the productive tools of accounting which has been providing the auditors with some accurate and specific acknowledgement and calculations. The tool carries an advantage of providing specific asset and liability valuation on the current basis to the users of the organisation reporting financial information. The tool is also known as the "mark to market" accounting practice as per the Generally Accepted Accounting Principles (GAAP) (Carcello et al. 2017). In simple language, fair value accounting could be stated as the way, company measures and reports the assets and liabilities values based on their actual or estimated fair market prices. The application of the concerned tool in United Kingdom is observed to be quite productive and providing actuary in the works of the auditors and the accounting personnel's. The tool provides accurate valuation, true income, and other advantages. These advantages has been adding on to the popularity and the applicability of the tool in the country.

Research Questions

The research questions are as follows:

1. What contribution does Fair Value Measurement tool makes to Accounting Department?

2. What challenges are faced by the external auditors in United Kingdom on utilising the Fair Value Measurement?

3. What are the advantages and the best solutions to mitigate the challenges of Fair Value Measurement?

4. What would you recommend for enhancing the accuracy and the production of Fair Value Measurement?

Literature Review

Fair Value Measurement in Accounting

As per Dennis et al. (2018), accounting carries multiple tools and techniques for its calculation of assets and liabilities which makes the working in accounting much more accurate and specific. The fair value measurement is among its accurate tools and techniques which is known for providing quality output but it does carry some limitations. The fair value is the market based calculation rather than specific in entity measurement. The measurement is done through some specific assumptions which is considered in by the market participants for pricing the assets and liabilities which also includes the risk assumptions. This marks that the entity's intention for holding an asset for settling or otherwise fulfils a liability is not relevant in measuring fair value. The measurement of the fair value done through an assumption that a transaction in the principal market for either the asset or for the liability which could also be stated that the market with the highest volume and level of activity. As per Yao et al. (2015), in the absence of a principal market, the assumption is that the transaction could take place in one of the most advantageous market. There are multiple inputs in the fair value measurement and these inputs helps in making the calculation or valuation in a more specific ad accurate manner.

Challenges presented by Fair Value Measurements to external audits in United Kingdom

As per Biondi et al. (2016), the International Accounting Standards has provided with some specifications on the rules and assumptions to be considered while fair value measurement which adds on to the quality of the tool. The auditors are the ones who faces multiple challenges in the execution of the fair value measurement and it specifies that the challenges needs to be worked on so that some productive and accurate data could be explored. The foremost challenge is that the fair value accounting estimations are expressed in the terms of the current value transactions or financial statements item which are based on the conditions prevalent on the date of measurement. The second challenge is that there is a need to incorporate judgement concerning the significant assumptions which are framed by others for example experts employed or auditor or engaged by the entity. The third challenge is that the non-availability of information or evidence and its reliability. There are multiple other challenges which are hidden in the valuation through the stated tool of accounting or auditing. It has been rightly stated by Abdullatif (2016), that the challenges in the application of the fair value measurement needs to be enhanced through providing some effective solutions to the challenges it faces in execution.

Research Methodology

Conducting a research carries multiple activities and the most significant decision that is to be taken is the choice of the methodology of the research. Research Methodology is the key ingredient towards the accurate and productive results to be achieved. There are mainly two types of methodologies through which the research could be conducted which are Qualitative and Quantitative and when both are applied together it's a mixed methodology. The Qualitative methodology is the graphical representation of the information and the data while the qualitative is the theoretical representation. The research which includes the presentation through both the methods that is mixed methodology. The concerned research explores the practical subject and this makes the application of the mixed methodology much more specific and productive for the research. The research would utilise the primary as well as the secondary data which would help in making the research results and conclusions quite specific and applicable (Collis et al. 2017). The primary data would be collected through conducting a survey of the auditors of some finance company who would provide the actual information on the fair value measurement s and its challenges. The survey would be conducted through closed ended questionnaire. The analysis of each of the respondents would be done through SPSS methods (Statistical Package for Social Sciences). The secondary data would also collected and that would be done through the sources such as the books, journals, articles, and various other links concerning accounting or to be specific fair value measurement tool. The secondary data would be collected through probability sampling as the specification of the accounting would make the information quite accurate. The sampling of the survey or the respondents would be done through the same tool that is probability sampling.

The research design, philosophy and approach would be applied descriptive design, positivism and abductive, respectively (Abdullatif, 2016). The choice of all the ingredient has been made in specification to the requirement of the research. The descriptive design would help in making a clear distinction among the various facts about fair value accounting, positivism philosophy would help in making the research much more acceptable and the abductive approach would align with the other two mentioned factors, which would make the conclusions of the research much more applicable (Sellhorn and Stier, 2019). The ethical consideration of the research is one of the vital ingredients and it helps in making the research authentic as well as applicable. In the concerned research the ethical consideration includes the Data Protection Act, which specifies the confidentiality of the survey respondents data and the specification of each of the authors for the secondary data would also be considered.

Discussion

The exploration of the Fair Value Measurement in concern to the external auditors of United Kingdom would provide the people with some hidden challenges getting identified which creates issue for the auditors at large. The challenges which would be identified some specific solutions would be provided to it as that would help in enhancing the tool of auditing and thus, accelerating the work. The fair value measurement is concerned with the valuation of the assets and liabilities on the current market price basis and thus, the identification of the challenges as per the perspective of the external auditors of UK would help in providing with a rectified and more accurate information or calculations. As per Cannon and Bedard (2016), Fai value measurement is among the most applied techniques by the external auditors and this makes the requirement of enhancing the tool, gradually with time. The fair value is the market based calculation rather than an entity specific measurement. The measurement is done through some specific assumptions which is considered in by the market participants for pricing the assets and liabilities which also includes the risk assumptions. This marks that the entity's intention for holding an asset for settling or otherwise fulfils a liability is not relevant in measuring fair value. The accounting department or the auditors are the ones which are demanded in every organisation and business as no business or organisation could carry out its activities without proper and accurate finance planning or records. The external auditors are also the ones who needs to follow up the laws and policies of the government for the specific country and thus, the accuracy of the auditors is quite significant and desired.

According to Glover et al. (2018), the valuation of the assets and liabilities on the market price basis provides multiple advantages which works in favour of the government as well as of the organisation. The research has rightly selected the methodology to be applied as the mixed methodology would help in justifying the data explored through each of the data collected that is secondary as well as primary. The survey of some external auditors of a company would provide the actual data or information on the application and the willingness of people to use the tool while the secondary data would help in providing the background and the future of the tool. Thus, the research has rightly selected the ingredients and the justification to its choices is accurate (Brink et al. 2016). The fair value measurement exploration would be widely applicable due to the consideration of the ethics in research and as the concerned department works as per the laws and policies of the government, the significance of ethics would add on to the authenticity of the research.

Conclusion

The exploration of fair value measurement would provide the people at large with some productive results which would help in enhancing the execution of the accounting activities in the business. The research would provide with specific recommendations and which would help the country in adding on to the accuracy in the auditing department which would impact the accounting sector at large. The significance of accounting department could be rightly acknowledged through the research and the consideration of all the relevant and accurate methodology and its ingredients would make the research authentic too. The research carries a future scope of exploring the fair value measurement on an international level or global level which would help in applying the solutions on a broader and wide scale.

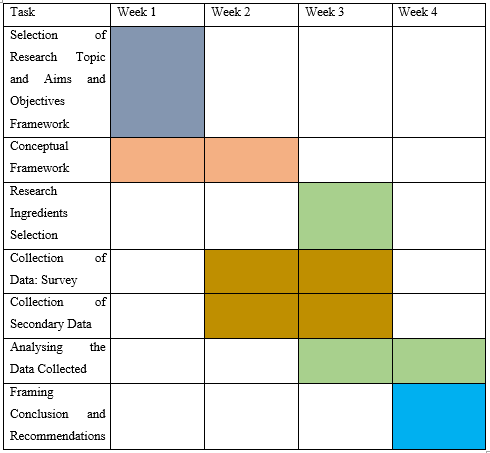

Time Schedule :

Get guaranteed satisfaction or money back under Accounting Proposal Assignment Help services of Expertsminds.com– order today new copy of this assignment!