ACC100 Principles Of Accounting, Polytechnic Institute Australia, Australia

ARE YOU LOOKING FOR RELIABLE ACC100 PRINCIPLES OF ACCOUNTING ASSIGNMENT HELP SERVICES? EXPERTSMINDS.COM IS RIGHT CHOICE AS YOUR STUDY PARTNER!

Tasks: Get approval from your lecturer for ASX listed company.

Calculate the ratio, write your interpretation of the ratio analysis in a report.

Answer: Aristocrat Leisure Limited

Introduction: Aristocrat Leisure Limited was established in 1984 in North Ryde, Australia. The company is engaged in developing, assembling, selling, distributing, and servicing of games and systems in Australia, New Zealand, the Americas, and internationally. There is a need to analysis profitability trend and liquidity trend effectively during the years 2017 and 2018.

Profitability Analysis: In order to determine gross profit performance, operating profit performance, net profit performance, and return on equity, an analysis over the profitability ratios is carried out which gives the measure of the company's growth and scope.

Gross Profit Ratio: It is basically a measure of the gross profit earning ability of a business by comparing the gross earnings and sales revenue. The ratio is critical for management for managerial decision-making process (Gerstel, 2002).

The ratio of Aristocrat is 55.56% in 2018 and 60.57% in 2017, which clearly reflects a decrease in the information, reason being that there is comparatively less jump in terms of sales than the jump in the price of the good put on sale in the period 2017-18. Therefore, the gross profitability performance of the company has decreasing trend in recent period including 2018 and 2017, even after this there is possibility of improvement of the firm's efficiency in the near future.

EXPERTSMINDS.COM ACCEPTS INSTANT AND SHORT DEADLINES ORDER FOR ACC100 PRINCIPLES OF ACCOUNTING ASSIGNMENT - ORDER TODAY FOR EXCELLENCE!

Operating Profit: It gives the measure of the main revenue earned for expecting growth in the main earnings companies' efficiency. The ratio has the importance of the management to control the operating expenses for improving the overall performance (Peterson & Fabozzi, 1999).

The ratio of Aristocrat is 24.75% in 2018 and 29.67% in 2017 supporting a downward trend in the performance of operating profit earning performance over the recent period including 2018 and 2017. One of the finest reason that results in decrease in the efficiency is a reduction in the gross profitability performance. The operating profit performance of the company is still sufficient to indicate future growth.

Net Profit: This ratio has significance for all the stakeholders including management, shareholders, and potential inventors. This ratio indicates the expected earnings from the investment in the shares of an entity (Ojugo, 2009).

The ratio of Aristocrat is 15.29% in 2018 and 20.18% in 2017 showing the decrease in the net profit earning performance. The main reasons for the decrease in perform are decreased in gross profit and an increase in the administrative expenses. The performance of the company is still sufficient to indicate a higher profit earning performance on the investment.

GET READYMADE ACC100 PRINCIPLES OF ACCOUNTING ASSIGNMENT SOLUTIONS - 100% PLAGIARISM FREE WORK DOCUMENT AT NOMINAL CHARGES!

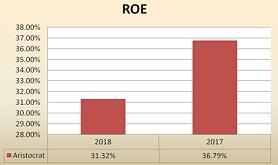

Return on Equity (ROE): This measure is very important in regards to the traders estimating the return on the investment and scope of future growth in the market. It measures the relationship between the equity and net income for expecting the earnings on equity investment (Gibson, 2008).

The ratio of Aristocrat is 31.32% in 2018 and 36.79% in 2017 which reflects downward trend in the performance but still the company has a high equity earning. It supports the profitability companies' efficiency which is high for supporting the future growth of the company.

Liquidity Analysis: The liquidity analysis indicates managerial efficiency in working capital management for the smooth running of a company. The liquidity ratios are supportive for finding the companies' managerial efficiency.

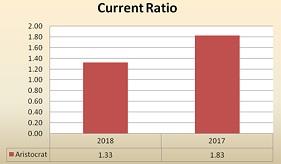

Current Ratio: It gives the measure of the firms' ability of covering the total liabilities through the total current resources. It is critical for managing the liquidity position for ensuring smooth running (Agtarap & Juan, 2007).

The ratio of Aristocrat is 1.33 in 2018 and 1.83 times in 2017 which shows sufficient liquidity level for covering all the current liabilities through sufficient level of the current assets. The company is highly capable for managing its working capital for smooth running. However, the company has downward trend in recent period including 2018 and 2017.

Quick Ratio: It is the measure of the payment ability of an entity for total liabilities with the highly marketable resent resources. It is important for expanding business through ad hoc opportunities (Agtarap & Juan, 2007).

If we closely look over the above graphs we'll find that in year 2018 the ratio of was a multiple of 1.17, while in year 2017, this ratio was a multiple of 1.65. It thereby gives the measure of the firm's ability to pay for the liabilities in regards to highly marketable resources. The firm's managerial capacity is efficient for managing its operational activities.

WE HELP STUDENTS TO IMPROVE THEIR GRADES! AVAIL TOP QUALITY ACC100 PRINCIPLES OF ACCOUNTING ASSIGNMENT HELP AND ASSESSMENT WRITING SERVICES AT CHEAPER RATE!

Conclusion: Based upon the above discussion, we have estimated the company's performance profitability which gives the measure of the firm's progress. It has high efficiency in operating earnings and return on equity along with net profitability performance. The company has sufficient liquidity position for meeting short-term financial obligation through the liabilities. It reflects the firm has an efficient managerial performance for managing the working capital.

Listed below some of the major courses cover under our Polytechnic Institute Australia, Australia Assignment Help Service, such as:

- ACC201 Financial Accounting Assignment Help

- ACC203 Management Accounting Assignment Help

- ACC202 Corporate Accounting Assignment Help

- ACC300 Auditing and Assurance Assignment Help

- ACC303 Advanced Management Accounting Assignment Help

- ACC302 Accounting Theory and Corporate Governance Assignment Help

- ACC304 Accounting Capstone Assignment Help

- MGT100 Introduction to Management Assignment Help

- ECO100 Economics for Business Assignment Help

- GBU200 Business Ethics and Corporate Social Responsibility Assignment Help